PST.NET

LinkPay

EPN

In the blink of an eye, you can create, use, and dispose of a payment card.

No, this isn’t a magician’s trick 🪄 – it’s what virtual payment tech can get you at your fingertips.

Want to experience it? I’ve got great news for you – virtual payment cards are here to save the day! These digital wonders act as a secure buffer between your actual card and the merchant, keeping your sensitive info safe from prying eyes.

Plus, with features like single-use numbers, spending limits, and instant card creation, managing your online expenses has never been easier.

But here’s the kicker: Many providers are offering sweet cashback rewards and sign-up bonuses. We’re talking up to 5% cashback on purchases and welcome offers worth up to $200!

Now keep on reading to get complete insights on the best virtual payment cards you cannot miss!

What are Virtual Payment Cards?

Virtual payment cards are digital counterparts to traditional credit or debit cards, crafted to boost security and ease for online shopping. They generate unique card numbers for each transaction, minimizing the risk of fraud and unauthorized use. Key features include:

- Enhanced Security: With single-use numbers, your actual card details remain protected.

- Spending Control: Set limits and monitor transactions in real time through mobile apps.

- Convenience: Easily create and manage cards without the need for a physical wallet.

These virtual payment cards are perfect for online shoppers, marketers, and businesses seeking a secure, flexible way to manage payments without exposing sensitive information.

Best Virtual Payment Cards You Cannot Miss

| Virtual Cards | Supported Platforms | Pricing/Fees | Differentiating Factor |

|---|---|---|---|

| LinkPay | Multiple ad platforms, including Google Ads, Facebook Ads, TikTok Ads | – No monthly fee – 0% deposit fee | Highest cashback offer and 0% deposit fee |

| EPN | Facebook Ads, Google Ads, TikTok Ads, Pinterest, Bing | – 2.5% card top-up fee – $10 monthly maintenance – Free card issuance for deposits over $30 | 22 trusted US bank BINs and cryptocurrency funding |

| PST.NET | Major advertising platforms | – Deposit fee of 2% – First 100 cards free (PST Private program) | Exclusive BINs from U.S. and European banks |

| COLIBRIX PARTNERS | Facebook Ads, Google Ads, TikTok Ads, Twitter Ads | – 1 EUR per card issued – No monthly maintenance – 0% transaction fees and decline fees | Unique US, UK & EU BINs with unlimited card issuing |

| MyBroCard | Facebook, Google Ads, TikTok | – First 50 cards free – $2 per card issued after | Direct top-up from affiliate networks |

| Capitalist Card Pro | Facebook, Google Ads | – $2.65 per card – $2.7 monthly fee | Flexible balance management options |

| Stellar Card | Facebook, Google Ads | – $100/month basic plan – $200/month premium plan | Focus on risk-free payments for ad platforms |

| AdPos | Major advertising platforms | – $1 per card – No monthly fee | Cost-effective for large-scale ad campaigns |

| Karta.io | Multiple platforms | – $100/month basic plan | Comprehensive expense management system |

| Multicards.io | Various merchants | – 2 EUR/USD per card | Strong focus on accounting integration |

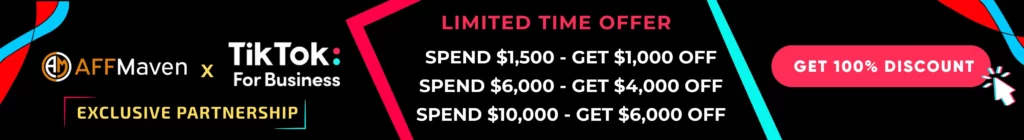

1. LinkPay

LinkPay stands out as the #1 virtual payment card, offering a seamless blend of security and convenience for both personal and business use. Designed to serve the modern financial industry, LinkPay allows users to spend cryptocurrency just like traditional currency, providing a hassle-free online shopping experience.

With its intuitive interface, users can easily manage their transactions and enjoy the flexibility of multi-currency accounts, including USD and EUR. LinkPay also supports a wide range of digital currencies, making it a versatile choice for global transactions. The platform’s strong features ensure that users can make secure payments and accept them with ease, all while benefiting from competitive market rates.

Linkpay Key Features

- 3% Cashback: Enjoy a generous 3% cashback on all purchases, enhancing your savings with every transaction.

- Zero Fees: Benefit from 0% deposit and withdrawal fees, ensuring you get the most out of your funds.

- Unlimited Virtual Cards: Issue up to 100 virtual cards for free, perfect for managing team expenses or personal budgeting.

- Seamless Integration: Easily integrate LinkPay’s Merchant feature to accept payments on your website in both fiat and cryptocurrencies.

Linkpay Pricing

LinkPay offers primarily 4 different plans including the Free, Plus, Pro, and Ultra Plans. The Free plan has no monthly fee but includes a 1% deposit fee and a 2% transaction fee. The Plus plan, at $59 per month, reduces transaction fees to 1.5% and offers 5 free cards. For $179 per month, the Pro plan provides 15 free cards and a 1% cashback. The Ultra plan, at $299 per month, is the best deal with 100 free cards, 3% cashback, and zero transaction fees.

2. EPN

EPN functions as an international virtual payment card service for affiliates and digital marketers. It manages online transactions across major advertising platforms like Facebook, Google, and TikTok.

Users can create multiple virtual cards instantly, connected to trusted BINs from US banks. This reduces the risk of account bans.

EPN accepts cryptocurrency funding, allowing quick top-ups via USDT or Bitcoin with low fees. The platform ensures security through two-factor authentication and anonymous transactions.

It includes transaction tracking tools and team management options for shared spending. With round-the-clock support and a simple interface, EPN serves as a dependable virtual payment solution for the affiliate marketing industry.

EPN Key Features

- Cryptocurrency funding: Instant top-ups using USDT or Bitcoin with competitive exchange rates.

- Multiple BINs: Access to 22 trusted US bank BINs for diverse advertising platform compatibility.

- Team management: Collaborative account control with budget distribution and card allocation features.

- API integration: Custom data tracking capabilities with open API code for developer flexibility.

EPN Pricing

EPN offers a tiered pricing structure with a 2.5% card top-up fee. Card issuance is free for deposits over $30. Monthly maintenance costs $10. The service charges 1% for cryptocurrency conversions. Unlimited cards are available after KYC verification.

3. PST.NET

PST.NET is a top choice for virtual payment cards, especially favored by businesses and marketers. Known for its strong security features, PST.NET offers cards with 3D Secure technology and exclusive BINs from U.S. and European banks, ensuring safe transactions across major advertising platforms like Facebook and Google Ads.

Users can enjoy instant card issuance and manage their finances with ease through a user-friendly interface. PST.NET also supports multiple currencies and payment methods, including cryptocurrencies, making it versatile for global transactions.

PST.NET Coupon Code: Upto 5% OFF

exclusive

- 20+ types of cards in USD & EUR

- Restful API support

- 0%transaction fee

PST.NET Key Features

- Up to 100 Free Cards: Ideal for media buying teams.

- 3% Cashback: Available through the PST Private program.

- No Transaction Fees: On select cards, enhancing cost-effectiveness.

- Real-Time Expense Tracking: Helps manage budgets efficiently.

PST.NET Pricing

PST.NET offers competitive pricing plans with standout options like the Ultima and PST Private cards. The Ultima card features a 0% withdrawal fee and starts at $7 per card, offering advanced security for all types of payments. The PST Private program provides up to 100 free cards, with additional cards costing just $1 each and a 2% deposit fee, making it ideal for high-volume media buyers.

4. COLIBRIX PARTNERS

COLIBRIX PARTNERS works as an international virtual payment card service built for affiliates, media buyers, and digital marketers. It manages online transactions across major advertising platforms like Facebook, Google, TikTok, Twitter, Amazon, and Reddit. Users can create unlimited virtual cards instantly, connected to trusted US, UK, and EU BINs with very high approval rates. This reduces the risk of declines and keeps your ad campaigns running smoothly without interruptions.

COLIBRIX PARTNERS accepts both fiat and cryptocurrency funding, so you can top up budgets instantly with no limits or minimum amounts. The platform is built for freedom in budget management, giving you full control over deposits and withdrawals. It also includes team management features, where you can add members with specific roles (Buyer, Admin, Supervisor, Mini-Buyer) and set clear limits.

The dashboard provides budget control, real-time expense tracking, and detailed transaction analytics. COLIBRIX PARTNERS supports contactless payments and works with Apple Pay and Google Pay to make spending easy across mobile campaigns. With fast KYC onboarding, transparent pricing, and 24/7 support, it’s a reliable virtual payment solution for scaling paid traffic operations.

COLIBRIX PARTNERS Key Features

- Unlimited funding: Top-up with fiat or crypto instantly with no minimums.

- Unique BINs: US, UK & EU BINs with high approval rates.

- Unlimited card issuing: Create multiple cards for campaigns and funnels.

- Team management: Assign roles, set limits, and control spend.

- Campaign analytics: Track and allocate expenses in real time.

COLIBRIX PARTNERS Pricing

COLIBRIX PARTNERS offers transparent pricing with 1 EUR per card issuance fee. There are no monthly maintenance charges or hidden costs. The service provides zero transaction fees and zero decline fees. Unlimited card creation is available after quick verification processes.

5. MyBroCard

MyBroCard is a leading choice for virtual payment cards, trusted by over 60,000 affiliates and 2,000 teams for its reliability and efficiency. This service allows users to issue an unlimited number of cards instantly, supporting both USD and EUR currencies. MyBroCard is perfect for online advertising on platforms like Google, Facebook, and TikTok, as well as for purchasing airline tickets or subscriptions.

The platform’s standout features include a user-friendly API for automation, detailed team management capabilities, and a wide range of BINs from various countries. Additionally, MyBroCard offers cashback of up to 100% on fees and provides the first 50 cards for free, making it an attractive option for businesses looking to streamline their financial operations.

MyBroCard Key Features

- Unlimited Card Issuance: Instantly issue cards with no restrictions.

- Multi-Currency Support: Cards available in USD and EUR.

- Comprehensive API Access: Automate tasks with user-friendly API and webhooks.

- Generous Cashback Offers: Up to 100% cashback on fees for eligible transactions.

MyBroCard Pricing

MyBroCard offers competitive pricing with a $2 card issuance fee and no commission on domestic payments. Users can start with 50 free cards and enjoy up to 100% cashback on fees. Top-up options include USDT with a 4% commission, Wire at 3%, and Capitalist at 7%.

6. Capitalist Card Pro

Capitalist Card Pro is a top-tier virtual payment card solution, particularly popular among media-buying teams and advertisers. It excels in managing complex advertising campaigns across platforms like Facebook and Google Ads. The card allows for unlimited issuance, providing flexibility for businesses needing multiple cards.

With support for both fiat currencies and cryptocurrencies, Capitalist Card Pro offers different funding options, including bank transfers and affiliate network payouts. Some of the standalone features include shared and separate balances, detailed transaction statistics, and team collaboration tools. This makes it an ideal choice for teams seeking efficient budget management and streamlined financial operations.

Capitalist Pro Card Key Features

- Unlimited Card Issuance: Create as many cards as needed for flexibility.

- Flexible Balance Management: Choose between shared or individual card balances.

- Different Funding Options: Use bank transfers, cryptocurrencies, or affiliate payouts.

- No Monthly Fees: Enjoy cost-effective management without recurring charges.

- Rapid Card Issuance: Instantly issue cards for immediate use.

Capitalist Pro Card Pricing

Capitalist Card Pro offers straightforward pricing with no monthly service fees. Card issuance costs $2.65, and transaction fees start at €0.50. Replenishing your Capitalist account is free, but card top-ups incur a 4.7% fee.

7. Stellar Card

Stellar Card is a preferred choice for virtual payment solutions, offering a seamless blend of security and convenience. Designed for both personal and business use, Stellar Card provides users with unlimited 1.5% cashback on every purchase, ensuring that you earn rewards without the hassle of tracking categories. The card also features contactless technology for secure and touch-free payments, enhancing user experience.

With free access to your FICO® score each month, Stellar Card helps you stay informed about your credit health. Additionally, its fraud protection system monitors your account for suspicious activity, providing peace of mind. Online and mobile account access allows you to manage spending and set up alerts easily, making Stellar Card a reliable tool for modern financial management.

Stellar Card Key Features

- Contactless Payments: Secure, simple, and touch-free transactions.

- Unlimited 1.5% Cashback: Earn rewards on every purchase without categories.

- Free FICO® Score Access: Monitor your credit health monthly.

- Advanced Fraud Protection: Alerts for any suspicious account activity.

- Online Account Management: Manage spending and set alerts anywhere, anytime.

Stellar Card Pricing

Stellar Card offers a straightforward pricing plan with two main options. The basic plan is available at $100 per month with a 4% commission on transactions, while the premium plan costs $200 per month with a reduced 3% commission. Both plans provide access to private BINs and support risk-free payments, making Stellar Card a reliable choice for secure online transactions.

8. AdPos

AdPos Virtual Card is a preferred choice for advertisers seeking efficient and reliable payment solutions. Tailored specifically for media buying, AdPos offers unlimited virtual cards that seamlessly integrate with major platforms like Facebook and Google Ads. This card service excels in bulk card management, allowing users to mass-produce cards for streamlined campaign handling.

AdPos stands out with its low commissions on card issuance and replenishment, ensuring cost-effectiveness without monthly maintenance fees. Users benefit from trusted BIN codes from Hong Kong and the USA, enhancing transaction reliability. Additionally, AdPos provides detailed real-time statistics and reports, enabling precise financial tracking and management for advertising teams.

AdPos Key Features

- Efficient Bulk Card Management: Mass-produce cards for streamlined campaign operations.

- Low Commissions: Enjoy minimal fees for card issuance and replenishment.

- Trusted BIN Codes: Utilize reliable BINs from Hong Kong and the USA.

- Quick Replenishment Options: Fund accounts via Wire, Crypto, or Capitalist.

- Detailed Real-time Reports: Access comprehensive transaction statistics and reports instantly.

AdPos Pricing

AdPos Virtual Card’s cost starts at just $1 per card, making it an affordable option for managing large-scale advertising campaigns. With no monthly maintenance fees, AdPos ensures cost-effectiveness while providing strong features like bulk card issuance and detailed financial reporting.

9. Karta.io

Karta.io Virtual Card is a standout option for businesses seeking efficient financial management and control. Known for its flexibility, Karta.io allows companies to issue unlimited virtual cards, making it ideal for managing diverse expenses across teams and projects. Each card can be customized with specific limits and tied to different budgets, ensuring precise control over spending.

The platform’s real-time transaction tracking and reporting enhance transparency, enabling businesses to make informed financial decisions quickly. Karta.io also offers robust security features, including tokenization and instant card freezing, to protect against fraud.

With seamless integration into existing financial systems, Karta.io streamlines expense management, making it a preferred choice for businesses aiming to optimize their financial operations.

Karta.io Key Features

- Unlimited Card Issuance: Create as many cards as needed for diverse expenses.

- Customizable Spending Limits: Set specific limits for each card to control budgets.

- Real-time Expense Tracking: Monitor transactions instantly for better financial oversight.

- Security Features: Utilize tokenization and instant card freezing to prevent fraud.

- Seamless Integration: Easily integrate with existing financial systems for streamlined management.

Karta.io Pricing

Karta.io Virtual Card offers flexible pricing plans tailored to business needs. The plans start at $100 per month with a 4% commission on transactions, providing access to unlimited card issuance and real-time expense tracking.

For businesses requiring more extensive features, a premium plan is available at $200 per month with a reduced 3% commission, offering additional benefits like customizable spending limits and enhanced security features.

10. Multicards.io

Multicards.io Virtual Card is a preferred solution for businesses seeking efficient financial management and streamlined payment processes. This service offers rapid issuance of virtual cards, enabling businesses to quickly adapt to changing financial needs. With support for multiple currencies, Multicard.io ensures seamless global transactions, making it ideal for international operations.

Multicard’s integration with accounting systems provides enhanced control over corporate finances, allowing for precise tracking and management of expenses. Additionally, Multicard.io optimizes spending on advertising and other business operations, offering flexibility and scalability to support business growth. These features make Multicard.io a versatile choice for companies looking to enhance their financial infrastructure.

Multicards.io Key Features

- Quick Card Issuance: Instantly issue virtual cards for immediate use.

- Multi-Currency Support: Facilitate global transactions with multiple currency options.

- Accounting Integration: Seamlessly integrate with accounting systems for financial control.

- Optimized Advertising Spend: Enhance efficiency in advertising and business operations.

- Scalability and Flexibility: Adapt to business growth with scalable solutions.

Multicards.io Pricing

Multicards.io offers flexible pricing with a card issuance fee of 2 EUR or 2 USD per card. Replenishment commissions range from 0% to 5%, depending on the payment method. There’s no monthly fee, and users can create unlimited cards with a minimum top-up of 50 EUR.

Virtual payment cards offer advanced security features that surpass traditional plastic cards. Tokenization replaces sensitive data with unique identifiers, protecting card information during transactions. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security.

Real-time fraud detection systems use AI to monitor transactions, instantly flagging suspicious activities. These measures combined make virtual cards a significantly safer option for online and mobile payments.

Quenching Queries Related to Virtual Payment Cards

How Secure are Virtual Payment Cards?

Virtual cards are highly secure as they use unique numbers for each transaction, reducing the risk of fraud and unauthorized use.

Can I Use a Virtual Card for In-Store Purchases?

Generally, virtual cards are designed for online transactions. However, some can be added to digital wallets for contactless in-store payments.

Do Virtual Cards Have Spending Limits?

Yes, most virtual cards allow users to set custom spending limits, enhancing control over expenses and budgeting.

Are there Fees Associated with Virtual Cards?

Fees vary by provider. Some offer free card creation, while others may charge for issuance or transactions. Check with your specific provider.

Can I Use a Virtual Card for Recurring Payments?

Some virtual cards support recurring payments, but it depends on the provider and the type of card (single-use vs. multi-use).

How Quickly Can I Get a Virtual Card?

Most providers offer instant virtual card creation, allowing you to generate and use a card immediately after approval.

Can Businesses Use Virtual Cards?

Yes, many businesses use virtual cards for expense management, online advertising, and streamlining accounts payable processes.

Do Virtual Cards Earn Rewards Like Physical Credit Cards?

This depends on the issuer. Some virtual cards linked to reward-earning accounts may accrue points or cashback similar to physical cards.

Whole New Experience Awaits

As we wrap up some of the best virtual payment cards, it is pretty clear that these virtual cards hold a lot of potential to be one of the primary transactional methods in day-to-day life, I mean how can you ignore the perks? From an affiliate or media buyer to a business owner looking to streamline expenses, there’s a perfect virtual card waiting for you. 🌍

Starting from unbeatable cashback offers to customizable spending limits, these digital dynamos put you in control of your finances. Plus, with top-notch security features like single-use numbers and real-time transaction monitoring, you can shop with confidence knowing your sensitive info is safe and sound. 😌

So, what are you waiting for?

Choose your preferred Virtual Payment card and upscale your operations to next level in a way never done before!

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)