Affiliate marketers bleed money picking the wrong mobile platform. Android floods emerging markets with cheap APK installs but pays lower CPI rates. iOS delivers premium CPA offers and RevShare deals but demands high-quality traffic.

After testing both ecosystems across thousands of campaigns, the pattern is clear. Android gives you scale for rapid testing. iOS hands you profit through higher lifetime value users. Smart affiliates never choose one platform—they balance both.

Here are exact CPI rates, conversion differences, app tracking challenges, and where to place your budget for maximum affiliate commissions without wasted spend every single day.

📊 The Market Share Paradox That Confuses New Affiliates

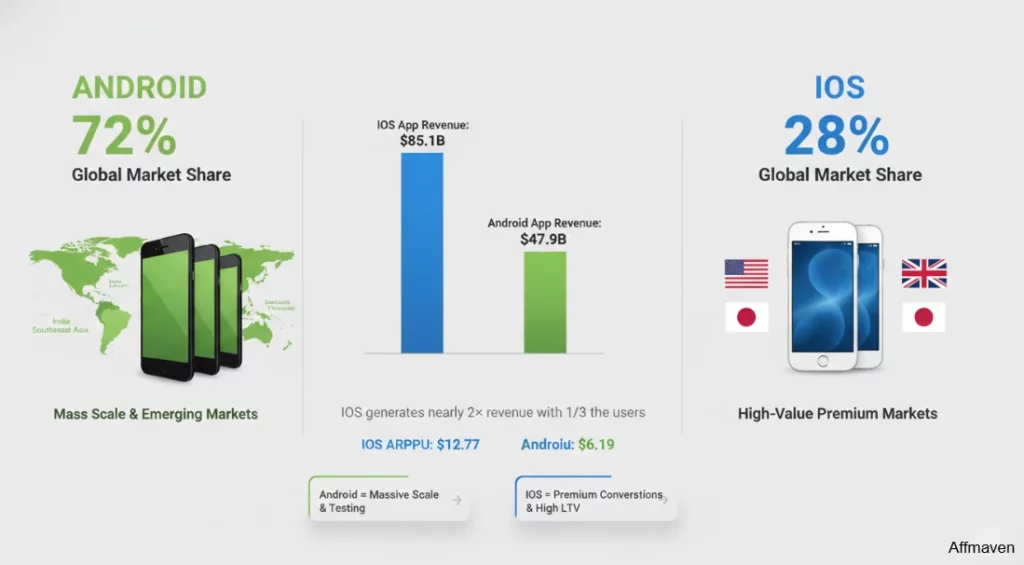

Android owns the world with 72% global market share, flooding emerging markets like India, Brazil, and Southeast Asia with affordable devices. iOS captures just 28%, yet dominates premium markets like the US (58% market share), UK, and Japan.

Here’s where it gets interesting for affiliates. iOS generated $85.1 billion in app revenue, whilst Android pulled in $47.9 billion despite having nearly 3x more users. iOS users average $12.77 per app purchase compared to Android’s $6.19.

This creates two distinct battlefields. Android offers scale and testing grounds. iOS delivers premium conversions and higher lifetime value. Neither is “better,” but both demand radically different approaches.

AffMaven’s Take: Test new offers on Android for quick validation, then scale proven winners on iOS for maximum profit. This dual-platform approach balances risk and reward.

💰 Follow the Money: CPI Rates Tell the Real Story

Cost per install rates reveal where advertisers put their money, and in 2026, the numbers paint a clear picture.

iOS CPI globally averages $1.50 to $3.50, whilst Android sits between $1.50 to $4.00 depending on geography and vertical. But dig deeper into tier one countries and you’ll see the real disparity.

Platform CPI by Major Markets

| Geography | Leading OS | iOS CPI Range | Android CPI Range | Best for Volume | Best for LTV |

|---|---|---|---|---|---|

| United States | iOS | $2.80 – $5.00 | $2.00 – $3.50 | Android | iOS |

| India | Android | $1.20 – $2.50 | $0.25 – $1.50 | Android | iOS |

| Brazil | Android | $1.50 – $3.00 | $0.30 – $1.50 | Android | iOS |

| United Kingdom | iOS | $2.50 – $4.00 | $1.80 – $3.20 | Android | iOS |

| Global Average | Android | $1.50 – $3.50 | $1.50 – $4.00 | Android | iOS |

The United States iOS market commands the highest CPIs, but delivers user retention rates of 23.9% on Day 1 compared to Android’s 21.1%. More importantly, iOS users maintain 12% retention by Day 30 versus Android’s 11%, creating compounding value over time.

🤖 Tracking and Attribution: Android Plays Fair, iOS Plays Hard

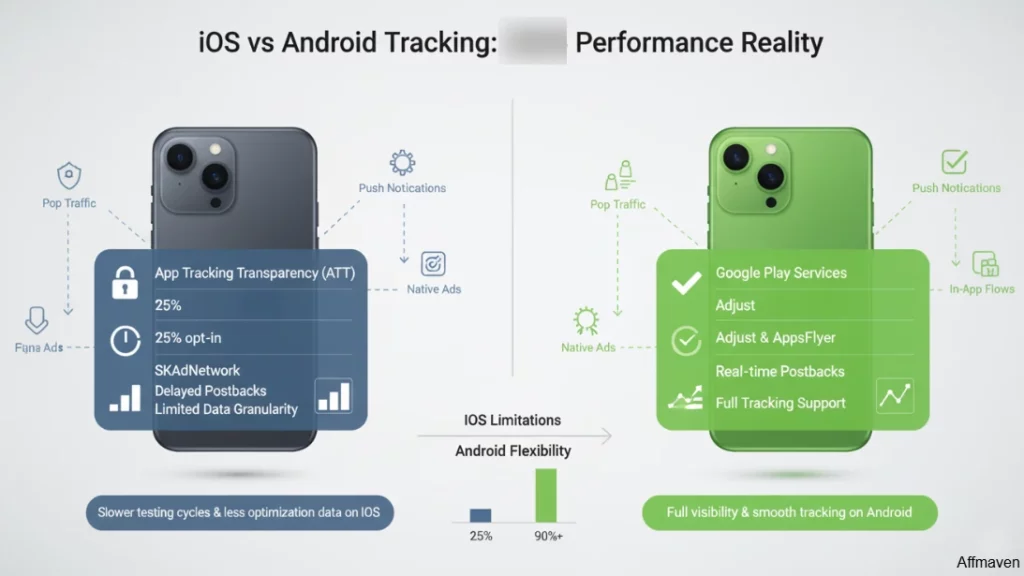

Apple’s App Tracking Transparency framework, rolled out with iOS 14.5, absolutely shredded user-level tracking. Only about 25% of iOS users opt into tracking in 2026, meaning most of your attribution data gets aggregated through SKAdNetwork.

SKAdNetwork delays postbacks, limits granular data, and forces advertisers to work with conversion values instead of actual user identifiers. For affiliates, this means less optimisation data and slower testing cycles.

Android remains the wild west by comparison. Google Play services and established SDKs like Adjust and AppsFlyer still provide robust tracking with postback integrations that work beautifully across traffic sources.

Pop traffic, push notifications, native ads, and in-app flows all track cleanly on Android. iOS restricts many of these formats or requires additional compliance layers.

Who Wins: Android dominates for affiliates requiring granular data and real-time optimization. iOS forces reliance on aggregated metrics and longer optimization cycles.

✅ Compliance and Distribution Flexibility

Speed to market matters when you’re testing offers. Here’s where the platforms differ dramatically.

Android approval takes anywhere from a few hours to 7 days, averaging around 3 days for updates. New apps might wait up to a week, but Google’s review process is generally more lenient. Plus, Android allows sideloading APKs, giving you distribution flexibility that iOS simply doesn’t offer.

iOS approval typically completes within 24-48 hours, with 50% of apps reviewed in under 24 hours. But Apple’s guidelines are brutally strict. One wrong metadata entry, one guideline violation, and you’re back to square one.

I’ve had Android campaigns live and profitable within 48 hours of concept. iOS campaigns with identical offers took a week due to review delays and guideline clarifications. Factor this timeline difference into your testing strategy.

Key Insight: Budget extra time for iOS approval cycles. Use Android for rapid creative testing, then adapt winning formulas to iOS compliance requirements.

🔥 Payout Models: CPI vs CPA vs RevShare

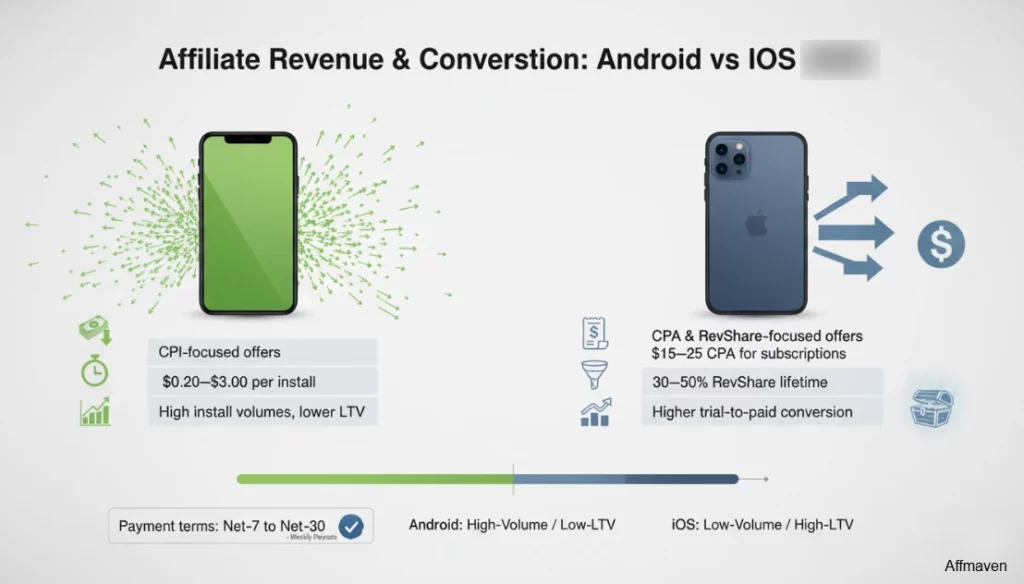

Android affiliate offers lean heavily toward CPI models due to lower user LTV and higher install volumes. You’ll see payouts ranging from $0.20 to $3.00 per install depending on geography and vertical.

iOS shifts toward CPA and RevShare models, especially for premium verticals. Why? Because iOS users complete trial-to-paid conversions at much higher rates.

A VPN offer might pay $1.20 CPI on Android but offer $15 to $25 CPA on iOS once the user subscribes. The catch? You need higher quality traffic to convert iOS users through longer funnels.

RevShare deals on iOS can hit 30% to 50% of subscription revenue for the lifetime of the customer. Given that iOS users stick around 2-3 times longer than Android users, the math gets juicy fast.

Payment terms typically run Net-7 to Net-30 depending on the network and conversion model. Affmaven runs weekly payouts for most flows, which helps with cash flow when you’re scaling.

AffMaven Strategy: Run Android CPI campaigns for initial market validation. Once an offer proves viable, shift budget to iOS CPA and RevShare models for sustainable profit. The Android volume confirms demand; the iOS quality builds business.

🎯 Traffic Sources That Convert on Each Platform

Each platform’s technical constraints shape viable traffic strategies differently.

Android thrives on aggressive traffic types. Pop-unders, push notifications, native ads, and in-app traffic convert well because Android users tolerate more interruption. Mobile pop-ads remain a staple for Android affiliate campaigns in 2026, despite declining effectiveness on desktop.

iOS users respond better to premium traffic sources. App Store Search Ads, social media campaigns (Facebook, TikTok), influencer collaborations, and UGC (user-generated content) flows drive quality iOS installs. The platform’s restrictions on certain ad formats mean in-page push replaces traditional push notifications.

Creative differences matter enormously. Android creatives can be raw and direct with download-focused CTAs. iOS creatives must feel native, branded, and trustworthy with App Store-focused messaging that doesn’t trigger rejection.

Winner: Android for diverse traffic source compatibility. iOS for quality over quantity traffic strategies.

🔥 Best Performing Verticals by Platform

After analysing thousands of campaigns across Affmaven’s network, here are the verticals crushing it on each platform.

Android Champions:

iOS Winners:

The pattern is clear. Android wins on volume-based offers with immediate utility. iOS wins on subscription-based services with recurring revenue models. Structure your campaign portfolio accordingly.

AffMaven’s Recommendation: VPNs and finance on iOS for revenue quality. Utilities and mass-market tools on Android for scale. Test eSIM offers on both platforms with platform-specific onboarding funnels.

The Balanced Portfolio Approach

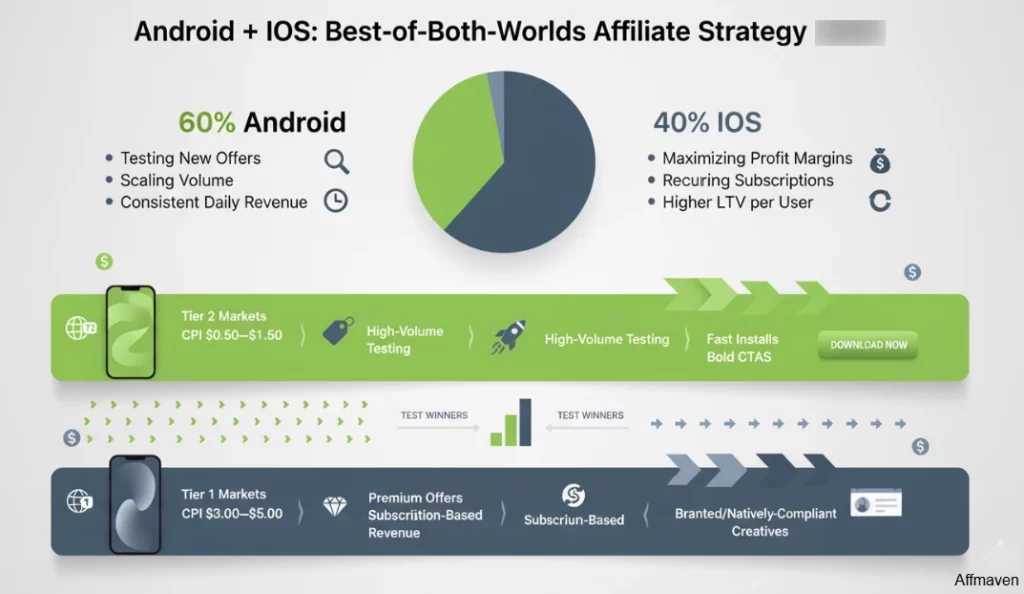

The affiliates earning serious money in 2026 aren’t choosing between Android and iOS. They’re running balanced portfolios that exploit each platform’s strengths.

Their typical split looks like this:

They test aggressively on Android in Tier 2 markets at $0.50 to $1.50 CPI. Winners get scaled on iOS in Tier 1 markets at $3.00 to $5.00 CPI with 2-3 times higher payouts that justify the increased acquisition cost.

This approach delivers the best of both worlds. Constant innovation and testing from Android’s volume. Premium revenue and sustainability from iOS’s quality users. That’s how you build a mobile affiliate business that survives algorithm changes, policy updates, and market shifts.

🧠 My Final Take After Ten Years in the Trenches

Mobile affiliate marketing generated over $210 billion in US ecommerce sales in 2025 alone. Both Android and iOS contribute massively to that number, but they serve different strategic purposes.

The industry is moving toward $31 billion in total valuation by 2031 with a compound annual growth rate of 8%. Mobile devices now drive 62% of affiliate traffic and generate 49% higher conversions than desktop.

Don’t let platform politics distract you from the real goal. Make money consistently by understanding where each ecosystem excels, then build systems that exploit both. That’s how you win in 2026 and beyond.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)