If we had a dollar for every affiliate crying about their TikTok campaigns getting nuked overnight, we’d probably own our own ad network by now!

The brutal truth? 2026’s platform restrictions just destroyed the traffic sources generating millions in gambling and nutra revenue.

While most marketers panic about Facebook bans and Google’s compliance nightmare, smart affiliates are already pivoting to alternative networks that actually convert better than the old social media playbook.

At AFFMaven, we’ve tracked over 200+ banned campaigns across major platforms to map exactly where iGaming and health supplement ads are getting blocked – and where they’re printing money.

The Great Platform Purge: Major Traffic Sources Under Fire

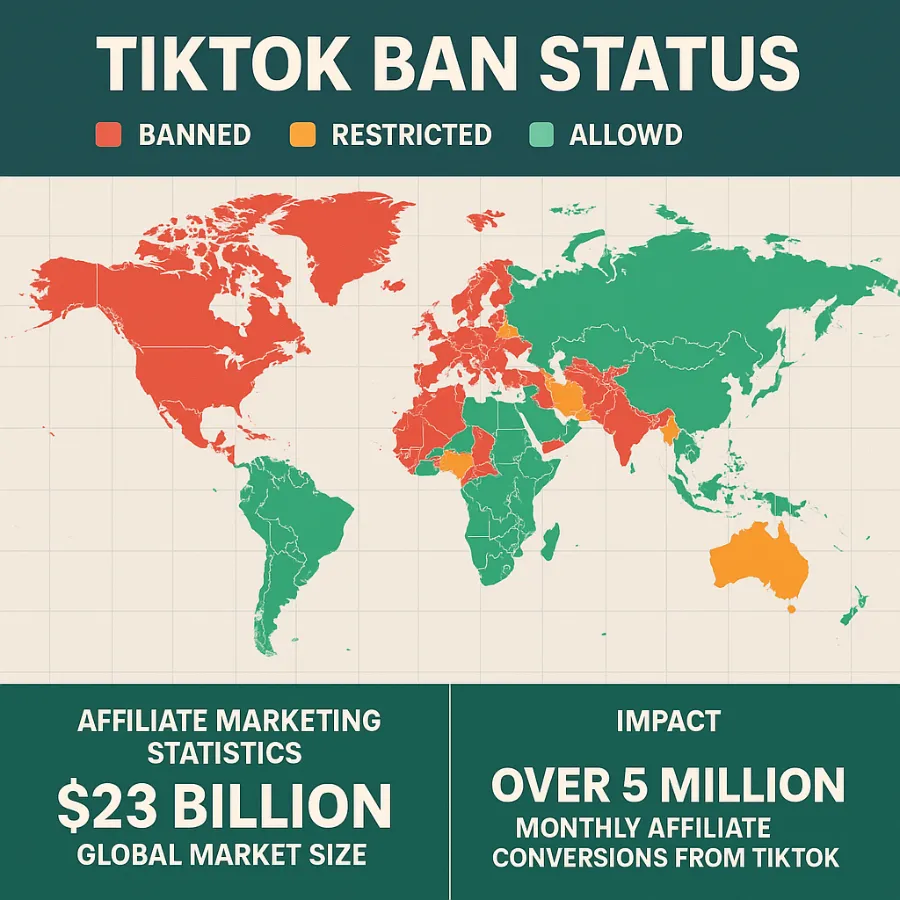

TikTok: The Global Domino Effect

TikTok’s situation in 2026 is proper dire. What started as US security concerns has snowballed into a global restriction fest that’s affecting millions of affiliates worldwide.

Here’s the current TikTok ban status that’s crushing campaigns:

| Country/Region | Ban Status | Impact on Affiliates |

|---|---|---|

| United States | Full ban enacted January 2025 | Complete loss of 170M+ users |

| European Union | Heavy restrictions under DSA | Gambling/nutra creatives blocked |

| India | Banned since 2020 | 200M+ users inaccessible |

| Albania | Year-long ban from late 2024 | Domestic market closed |

| Afghanistan | Complete prohibition | Zero access |

The US Supreme Court upheld the TikTok ban in January 2025, making America the first major economy to completely block the platform. For affiliates, this means losing access to one of the highest-converting demographics – US users aged 18-34 who were prime targets for gambling and nutra offers.

What’s mental is the speed of these changes. One day you’re scaling a winning campaign, the next day your entire traffic source is gone.

Claim $1000 TikTok Ad Credits Before the Ban Hits!

exclusive

Facebook and Instagram: The Moderation Massacre

Meta’s platforms have become absolute nightmares for gambling and nutra affiliates in 2026. The company’s AI moderation has reached new levels of aggressiveness, particularly targeting health and gambling-related content.

Key restrictions hitting affiliates hard:

The compliance requirements have become insane. Google’s new gambling policy, effective April 2025, demands additional licensing documentation and responsible gambling messaging for every single ad. Facebook’s following suit with similar restrictions.

One major change that’s killing campaigns: Meta now requires verified business licenses for any health-related claims, even for basic supplement promotions.

Google Ads: The White-Hat-Only Zone

Google Ads has essentially become a white-hat-only platform for gambling and nutra verticals. The search giant’s updated policies make it nearly impossible to run grey-area campaigns without sophisticated cloaking.

Recent Google changes crushing affiliates:

The brutal reality: Generic nutra campaigns that worked in 2024 are getting rejected within minutes in 2026.

Geographic Restrictions: Where You Simply Can’t Advertise

China: The Great Firewall Expansion

China remains virtually impenetrable for Western affiliate campaigns. Facebook, Instagram, YouTube, and most Western ad networks are completely blocked. Even VPN usage has become riskier as authorities crack down harder.

Russia: The Extremist Designation Chaos

Meta’s recognition as an extremist organisation in Russia has created massive headaches for affiliates. While some use proxy services, account stability is non-existent, and mass bans happen weekly.

European Union: GDPR and DSA Double Trouble

The EU’s Digital Services Act (DSA) has supercharged restrictions on gambling and nutra content. Platforms face massive fines for non-compliance, so they’re erring on the side of caution by blocking everything.

Key EU challenges:

The Nutra Vertical: Fighting for Survival

Nutra has become one of the most challenging verticals to run profitably in 2026. Platform restrictions, combined with increased competition, have squeezed margins to breaking point.

Facebook’s Nutra Nightmare

Running nutra on Facebook in 2026 requires military-grade precision. Here’s what actually works:

Winning strategies for Facebook nutra:

The brutal truth: Most affiliates are seeing 60-70% higher CPAs compared to 2024, with lower approval rates across the board.

Google Ads: The Compliance Maze

Google’s requirements for nutra have become absolutely mental. You need:

Smart affiliates are pivoting to educational content and building audiences before promoting any products.

Gambling: High Rewards, Higher Risks

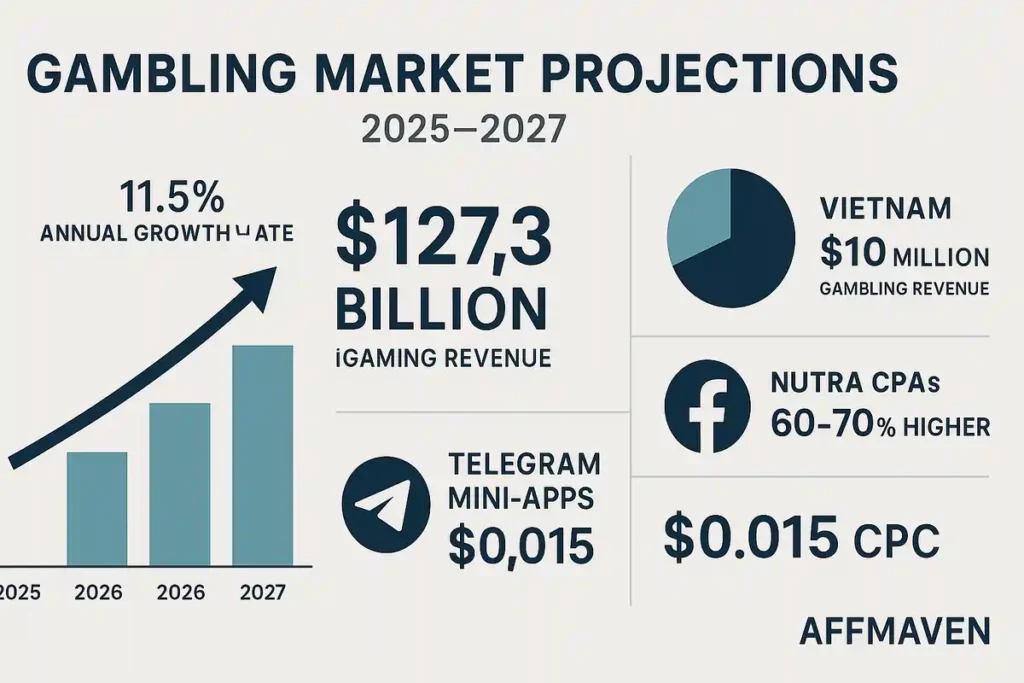

The gambling vertical remains massively profitable – if you can get around the restrictions. iGaming revenue is projected to hit $127.3 billion by 2027, but accessing that market has become increasingly difficult.

Platform-Specific Gambling Restrictions

| Platform | 2026 Status | Workarounds |

|---|---|---|

| TikTok | Completely banned globally | Organic content only (risky) |

| Licensed operators only | Sophisticated cloaking required | |

| Extensive documentation needed | White-hat approach mandatory | |

| Telegram | Official ads restricted | Mini-app advertising emerging |

The Rise of Alternative Gambling Networks

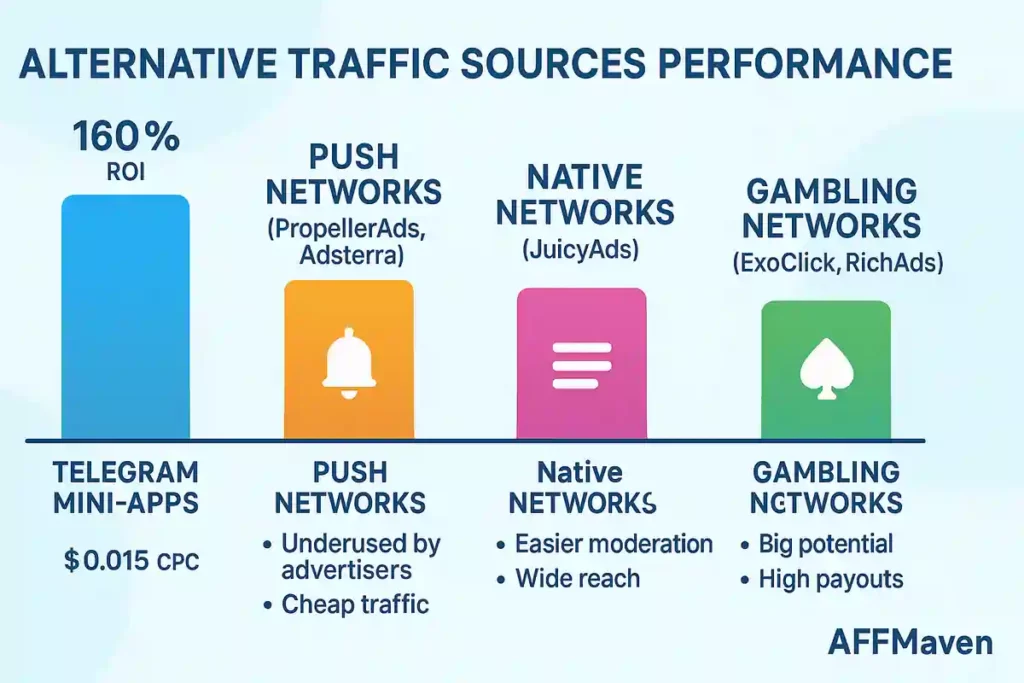

Specialised gambling ad networks are absolutely crushing it in 2026.Networks like ExoClick, PropellerAds, and RichAds offer dedicated gambling traffic without mainstream platform restrictions.

Why gambling networks are winning:

- No content restrictions for licensed operators

- Dedicated compliance teams handling regulations

- Higher conversion rates due to intent-based traffic

- Consistent traffic volumes regardless of platform bans

Emerging Traffic Sources: Where Smart Money Is Moving

Telegram Mini-Apps: The Hidden Goldmine

Telegram Mini-Apps have become the secret weapon for savvy affiliates in 2026. Unlike official Telegram ads, these placements appear in bots and tap-to-earn games with zero content restrictions.

Telegram Mini-App advantages:

One case study showed 160% ROI for gambling campaigns using Telegram Mini-Apps compared to traditional social platforms.

Push and Native Networks: The Reliable Workhorses

While social platforms impose restrictions, push and native networks continue delivering. These formats work brilliantly for both gambling and nutra because:

Top performing networks include:

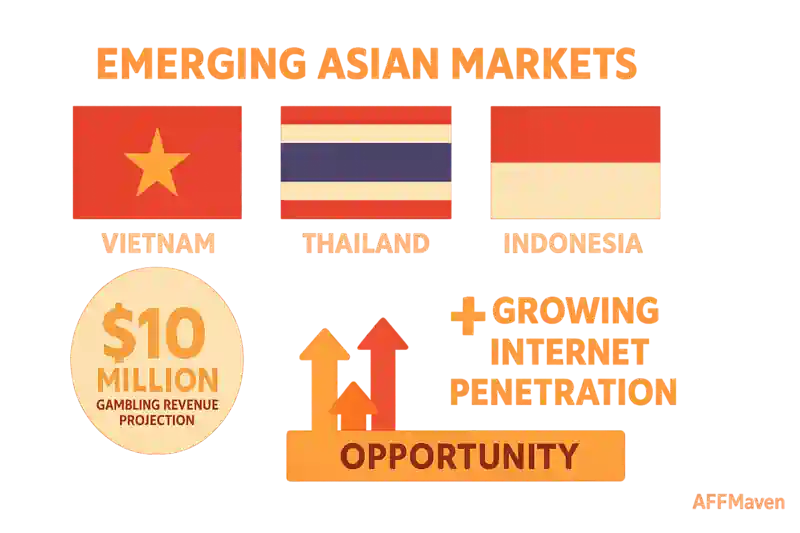

Emerging Asian Markets: The New Frontier

Vietnam, Thailand, and Indonesia are becoming absolute goldmines for gambling campaigns. These markets offer:

Vietnam alone projects 10 million in gambling revenue by 2027, making it a priority target for smart affiliates.

Compliance Strategies That Actually Work in 2026

The White-Hat Pivot

Successful affiliates are embracing compliance rather than fighting it. This means:

Advanced Cloaking Techniques

For those still running grey campaigns, cloaking has evolved significantly. Modern techniques include:

The 2026 Adaptation Playbook

Diversification Is Everything

Smart affiliates aren’t relying on single traffic sources anymore. The winning approach involves:

Build Your Own Traffic

The most successful affiliates in 2026 are building owned media:

This approach provides immunity from platform restrictions and creates sustainable long-term business.

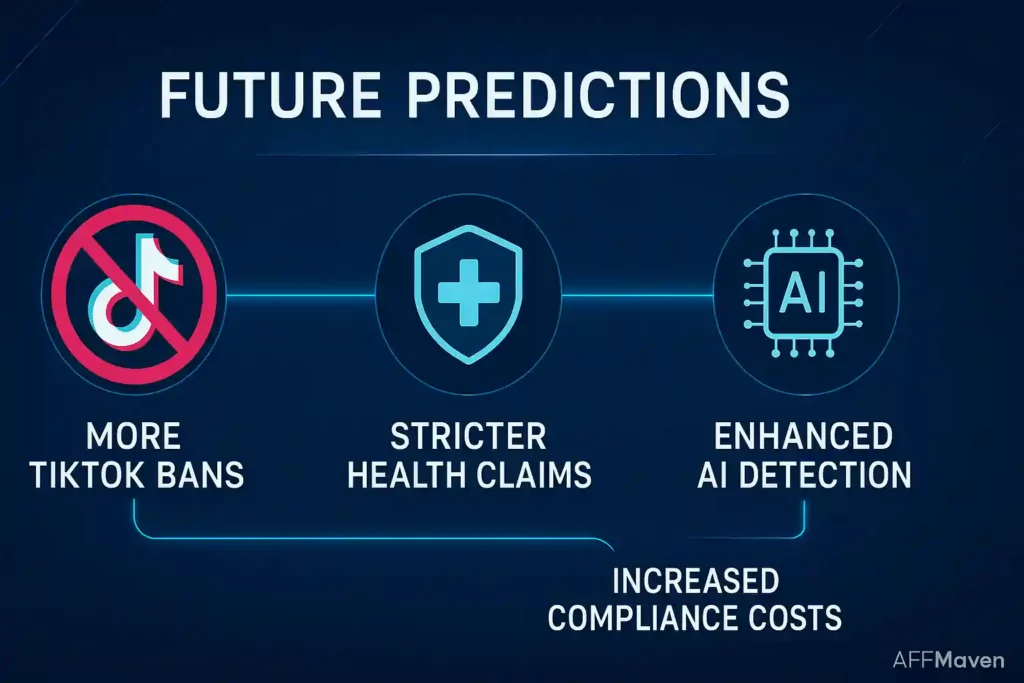

What’s Coming Next: Future Predictions

The restriction trend will continue accelerating through 2026 and beyond. Expect:

However, opportunities remain massive for affiliates willing to adapt. The gambling market continues growing at 11.5% annually, and nutra demand remains strong despite restrictions.

Final Thoughts: Adapt or Die

Campaign bans hit over 67% of affiliate marketers in 2026, while traffic costs jumped 60-70% across major platforms. With TikTok banned in 19 countries and Meta’s AI nuking accounts faster than ever, only the smartest affiliates are still banking serious cash.

The $127.3 billion iGaming market keeps growing, but accessing it means playing by completely new rules. Alternative networks and Telegram Mini-Apps are saving campaigns, while traditional Facebook and Google strategies are dying fast.

Smart money moved months ago to push networks, native ads, and emerging Asian markets where competition stays low and conversion rates stay high.

Which traffic sources are keeping your campaigns alive this year?

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)