Gambling affiliates are supposedly fleeing their golden goose en masse, but the reality tells a different story.

While countless forum threads debate the death of iGaming affiliate marketing, seasoned media buyers who understand the numbers aren’t packing their bags – they’re adapting their strategies.

The global iGaming market will cross $107.3 billion in 2026, representing an 11.5% compound annual growth rate, yet affiliate chats are filled with burnout stories and exit strategies.

This disconnect reveals something crucial: affiliates aren’t running from gambling itself, but from outdated partnership models that drain profits and sanity alike.

♠️ The Great Gambling Affiliate Migration: Fact or Fiction?

Recent industry analysis shows that approximately 74% of iGaming operators still rely heavily on affiliate marketing, with 30-40% of new customers acquired through affiliate channels.

Yet many solo arbitrageurs and small teams are exploring alternatives like nutra, crypto, and dating verticals.

The nutraceutical market alone is projected to reach $986.85 billion by 2032, growing from $458.55 billion in 2024.

Meanwhile, crypto affiliate programs offer commission rates ranging from 30% to 50% on trading fees. These figures certainly look appealing when you’re battling Facebook’s moderation algorithms daily.

🎰 Where Gambling Affiliates Are Actually Moving

| Alternative Vertical | Average Commission | Market Size (2026) | Key Challenge |

|---|---|---|---|

| Nutraceuticals | $30-40 per sale | $500.62 billion | High competition, lower payouts |

| Crypto Trading | 30-50% commission | Growing rapidly | Regulatory uncertainty, scam risk |

| Dating | $20-80 CPA | Stable but mature | Saturated markets, strict policies |

| Essay Writing | $15-25 per order | Niche market | Limited scale potential |

However, switching verticals means starting from scratch.

A gambling affiliate’s expertise in player psychology, bonus structures, and gaming regulations becomes irrelevant when promoting weight-loss supplements or crypto exchanges.

🤑 Why Smart Money Stays in Gaming: The Numbers Don’t Lie

The gambling vertical represents approximately 70% of the entire affiliate marketing industry, leaving just 30% for all other niches combined.

Major media buying teams like Devils, MGA Team, and All Traffic Group haven’t abandoned gambling – they’ve diversified while keeping iGaming as their primary revenue driver.

🎲 iGaming vs Alternative Verticals: Performance Metrics

| Metric | iGaming | Nutra | Crypto | Dating |

|---|---|---|---|---|

| Average CPA | $150-400 | $30-40 | $50-200 | $20-80 |

| Commission Range | 25-35% RevShare | 10-20% | 30-50% | 15-25% |

| Traffic Volume | 35B+ monthly impressions | High | Medium | High |

| Competition Level | High but profitable | Extremely high | Volatile | Saturated |

| Regulatory Risk | Moderate | Low | High | Low |

MGA Team processes $100,000 daily across multiple verticals, yet gambling remains their foundation.

All Traffic Group maintains $500,000 monthly revenue through diversification, but their core profitability still stems from gaming offers.

🚩 The Real Problem: Outdated Partnership Models, Not the Vertical

The issue isn’t gambling’s profitability – it’s the traditional affiliate model’s structure.

Standard gambling affiliate networks charge 25% commission while providing minimal support, delayed responses, and sudden offer cancellations.

Modern affiliate marketers face these pain points:

⚔️ Traditional vs Modern Affiliate Models

| Aspect | Traditional Networks | Subscription Models | Direct Partnerships |

|---|---|---|---|

| Commission Structure | 25% + hidden fees | Fixed monthly fee | Negotiable rates |

| Payment Terms | NET 30-60 | Weekly/Bi-weekly | Flexible |

| Offer Stability | Unpredictable | Guaranteed access | Long-term contracts |

| Support Quality | Generic | Dedicated | Direct contact |

| Transparency | Limited | Full disclosure | Complete access |

📊 Market Data Reveals the Truth About Affiliate Movement

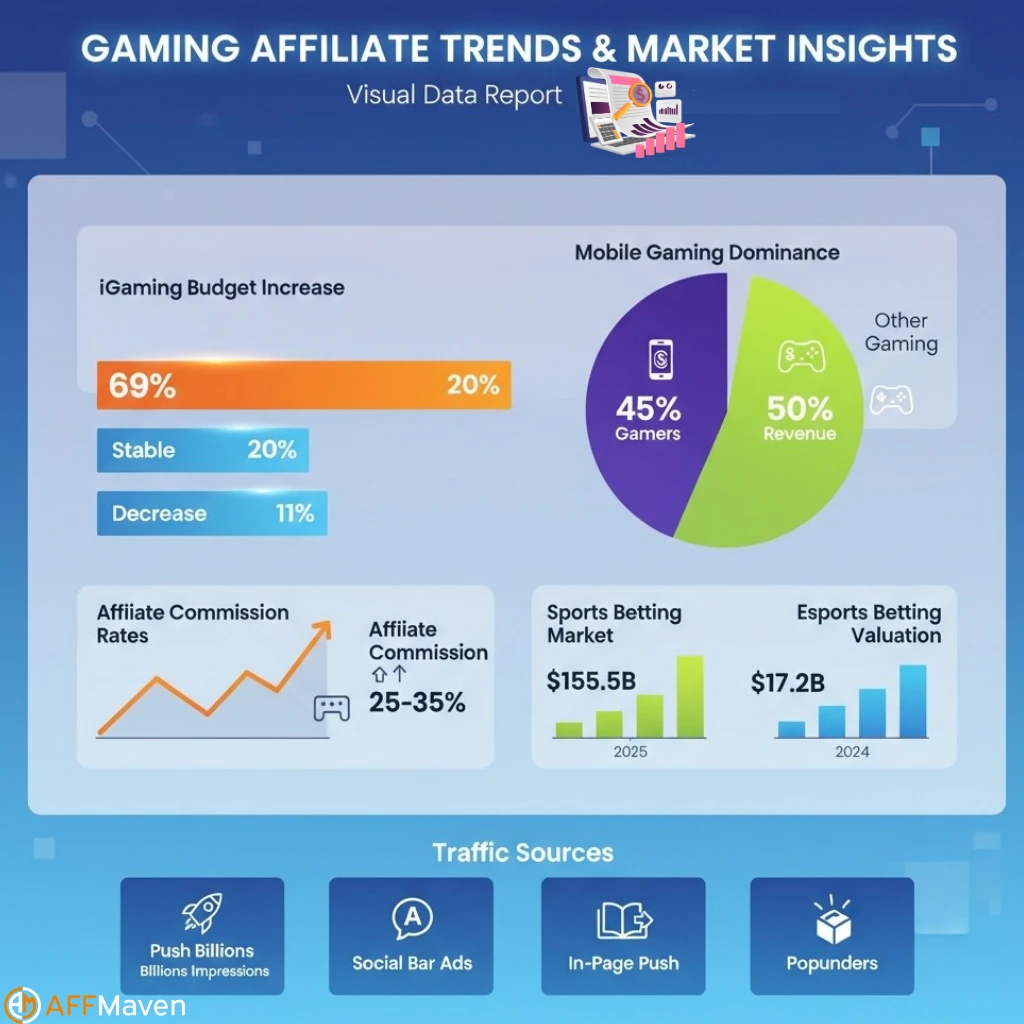

Recent surveys indicate that 69% of iGaming companies plan to increase their affiliate marketing budgets, contradicting the narrative of affiliate abandonment.

The global gaming market generated $200 billion in 2023, with 45% of gamers preferring mobile platforms.

Key Performance Indicators for 2026:

Traffic sources are evolving rapidly. Push notifications now account for billions of daily impressions, while social bar ads generate 9.9 billion monthly impressions through networks like Adsterra.

In-page push ads and popunder formats continue delivering strong performance for gambling campaigns.

✅The Subscription Revolution: Gaming’s Future Partnership Model

Subscription-based affiliate programs are emerging as the solution to traditional partnership frustrations. Instead of competing for scraps through commission structures, affiliates pay a fixed monthly fee for unlimited access to premium offers and support.

Benefits include:

This model appeals particularly to experienced arbitrageurs generating $50,000+ monthly, who understand that paying upfront for premium access generates higher net profits than traditional commission splits.

🪙 Cryptocurrency’s Impact on Gaming Affiliate Models

Crypto casino affiliate programs are revolutionising payment structures, offering 25-50% commission rates with instant blockchain transactions.

Bitcoin and Ethereum-based platforms eliminate traditional banking delays while providing enhanced privacy for both affiliates and players.

Crypto advantages:

However, regulatory uncertainty and platform reliability concerns keep many affiliates cautious about fully embracing crypto-only partnerships.

🏆 Essential Traffic Sources for Gaming Success in 2026

Quality traffic acquisition remains crucial regardless of partnership model. Adsterra leads the gaming traffic space with 11.9 billion monthly pop impressions and 9.9 billion social bar impressions, protected by 3-level security systems

Top-performing ad formats for gambling:

Adsterra’s targeting capabilities include 20+ parameters for precise audience segmentation, automated bidding strategies, and CPA goal optimization.

Minimum deposits start at $100, making it accessible for both testing and scaling phases.

🎰 The Verdict: Stay and Adapt, Don’t Flee

The data clearly shows that successful gambling affiliates aren’t leaving – they’re upgrading their approach. While some smaller players chase perceived opportunities in oversaturated niches like nutra, smart money recognises gambling’s continued dominance.

The solution isn’t vertical switching but model evolution. Subscription-based partnerships, crypto payment integration, and premium traffic sources like Adsterra represent the future of profitable gambling affiliate marketing.

Rather than abandoning the most lucrative affiliate vertical, successful marketers are demanding better partnership terms, investing in quality traffic sources, and building sustainable systems that eliminate traditional pain points.

Ready to scale your gaming campaigns with premium traffic?

Adsterra’s gaming vertical delivers billions of monthly impressions from verified publishers, ensuring your offers reach engaged audiences ready to convert. Start with just $100 and access advanced targeting options, automated optimization tools, and 24/7 multilingual support designed specifically for gambling affiliates.

The gambling affiliate gold rush isn’t over – it’s just getting more sophisticated. Those who adapt their strategies will continue profiting while others chase diminishing returns in overcrowded alternatives.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)