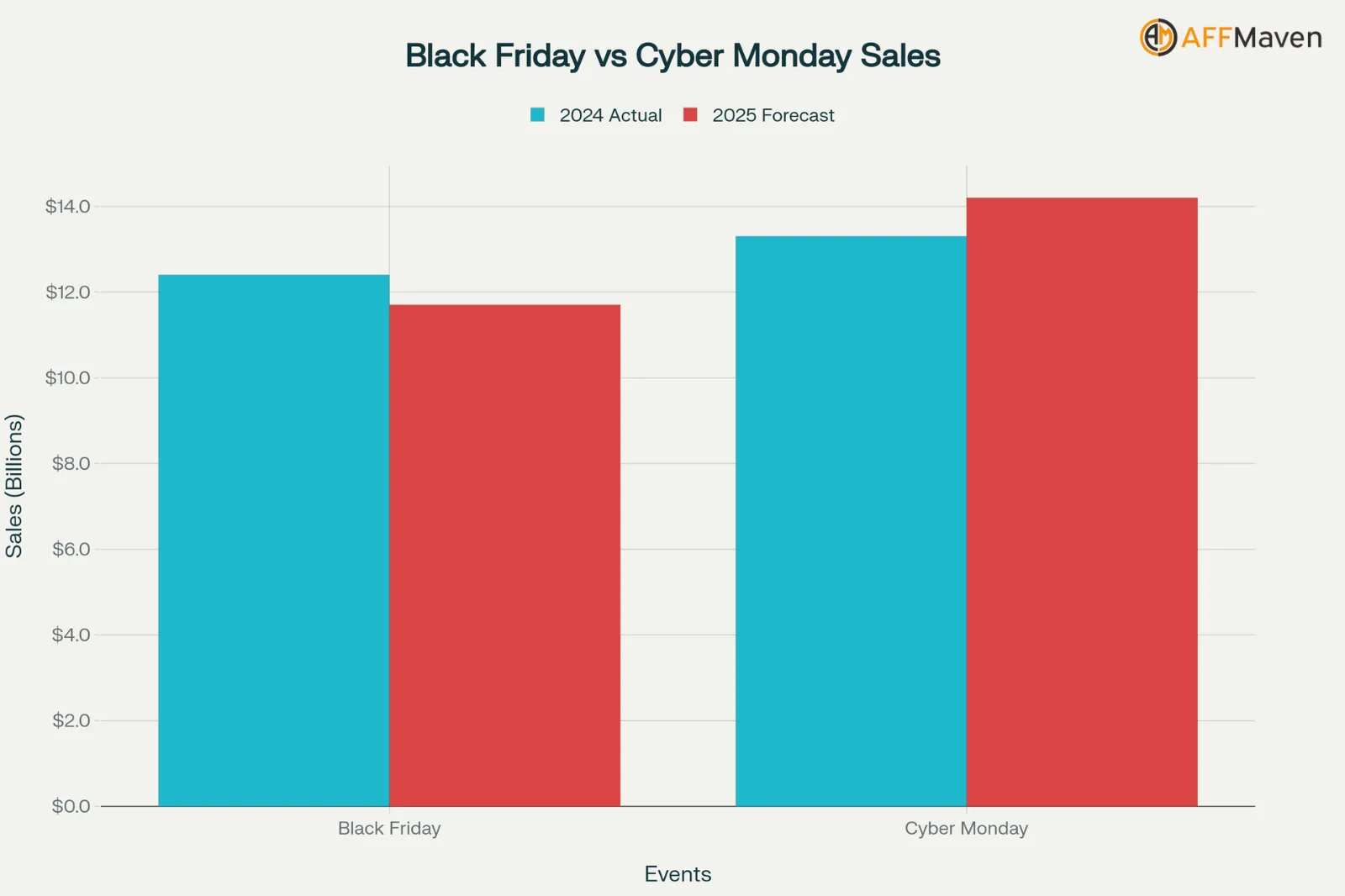

Cyber Monday generated $13.3 billion in online sales during 2024, crushing Black Friday by nearly a billion dollars in digital spending.

If you need the latest Cyber Monday Statistics to plan your holiday strategy or understand shopper behavior, this breakdown shows exactly where consumers spend and what they buy.

Mobile devices powered 57% of total sales, while the peak shopping hour hit $15.8 million per minute. From discount patterns to flexible payment trends, we’ve collected fresh 2025 data on shopping habits, bestselling categories, and conversion rates that drive results for retailers and marketers.

During the busiest Cyber Monday hour, Americans spent more per minute than most families earn in an entire week.

Key Cyber Monday Statistics for 2025

Cyber Monday vs. Black Friday

While Black Friday traditionally kicks off the holiday shopping season, Cyber Monday has surpassed it in online sales. This shift reflects a strong consumer preference for online-exclusive deals and the convenience of shopping from anywhere.

For retailers, Cyber Monday stands out as the dominant shopping holiday for e-commerce sales.

Also Read 👉Black Friday Statistics

Historical Cyber Monday Sales Growth

Year-over-year sales data for Cyber Monday illustrates a consistent and powerful growth pattern. A minor dip in 2021 was an outlier in an otherwise steady climb, with the event rebounding strongly in subsequent years.

| Year | Total Cyber Monday Sales (in Billions) | Year-Over-Year Growth (%) |

|---|---|---|

| 2025 (Forecast) | $14.2 | 6.7% |

| 2024 | $13.3 | 7.3% |

| 2023 | $12.4 | 9.6% |

| 2022 | $11.3 | 5.6% |

| 2021 | $10.7 | -0.9% |

| 2020 | $10.8 | 14.9% |

| 2019 | $9.4 | 19.0% |

Cyber Monday sales growth in billion USD from 2019 to 2025 forecast, highlighting steady increase and forecasted 2025 high.

Mobile Commerce: The Driver of Cyber Monday

Mobile shopping is no longer a secondary channel; it is the primary way consumers engage with Cyber Monday. The convenience of smartphones has made them the go-to device for browsing deals and making purchases.

These figures show that a mobile-first strategy is not just an option but a necessity for retailers.

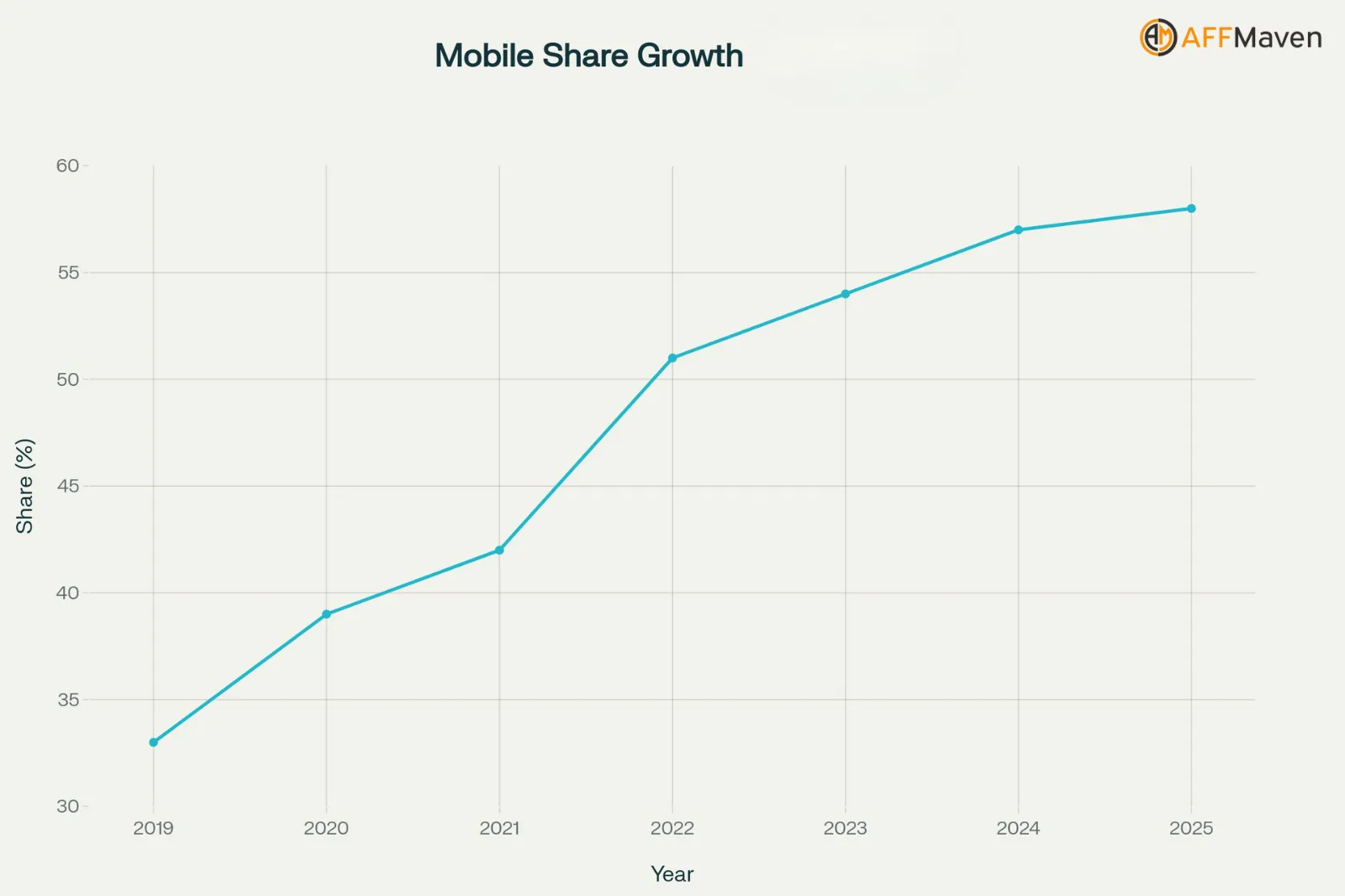

Mobile Shopping’s Unstoppable Rise

Share of sales coming from mobile devices has seen a dramatic increase over the last few years. This trend highlights a fundamental shift in how people prefer to shop during major sales events.

| Year | Mobile Share of Sales |

|---|---|

| 2025 (Estimate) | ~58% |

| 2024 | 57% |

| 2023 | ~54% |

| 2022 | ~51% |

| 2021 | ~42% |

| 2020 | ~39% |

| 2019 | 33% |

This rapid adoption of mobile commerce is a defining characteristic of modern Cyber Monday events.

Desktop vs. Mobile: A Look at User Behavior

While mobile dominates traffic and is growing in sales, desktop computers still play a part in the shopping journey. Users often use different devices for different stages of the buying process.

Understanding this device interplay helps retailers optimize the user experience across all platforms.

Cyber Monday Shopper Participation

Cyber Monday consistently attracts a massive number of shoppers, both online and in-store. While the event is digitally focused, it also drives foot traffic as retailers extend their online offers to physical locations.

Such high participation numbers make Cyber Week a critical period for the entire retail industry.

Generational Shopping Habits and Trends

Younger generations, particularly Gen Z and Millennials, are the most active participants in Cyber Monday. Their digital-native habits and comfort with online shopping make them the core audience for this event.

- In 2025, 57% of Gen Z and Millennial consumers in the US stated they were likely to make a purchase during Cyber Week.

- In contrast, only 38% of Gen X and Baby Boomers planned to participate in the sales.

- Despite their enthusiasm, Gen Z is also the most budget-conscious, with plans to reduce holiday spending by 23% in 2025.

These generational differences in spending and participation are key for targeted marketing efforts.

What Motivates Cyber Monday Shoppers?

Discounts are the primary draw for Cyber Monday, but shoppers are also looking for value and a good experience. Some consumers are growing wary of sales events, making transparency and genuine deals more important than ever.

Retailers must balance attractive offers with trustworthy practices to maintain consumer engagement.

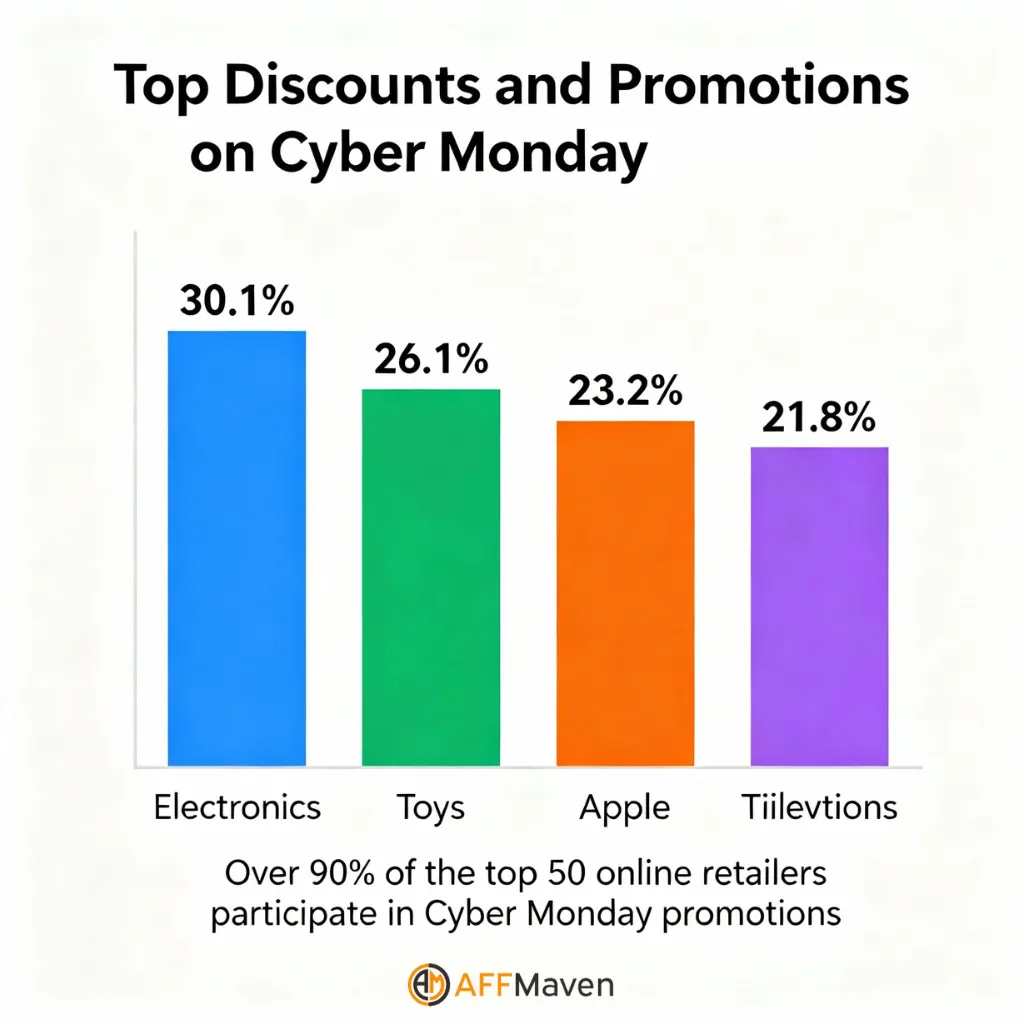

Top Discounts and Promotions

Cyber Monday is known for offering some of the deepest discounts of the year, particularly in certain product categories. Electronics consistently lead the way, but other areas also see significant price drops.

Other categories with substantial markdowns included toys (26.1%), apparel (23.2%), and televisions (21.8%).

Such price reductions are the primary reason for the huge volume of consumer purchases during the shopping event.

Best-Selling Product Categories

The massive increase in shopper activity on Cyber Monday leads to explosive growth in certain product categories. Gifting categories like toys and personal care see some of the largest sales spikes.

This data shows which sectors benefit most from the Cyber Monday frenzy.

Most Popular Items of Cyber Monday

Beyond broad categories, specific products consistently emerge as top sellers each year. These items often include popular tech gadgets, trending toys, and highly anticipated video games.

Yearly best-sellers often mirror the primary cultural and technological movements.

The Rise of “Buy Now, Pay Later” (BNPL)

Flexible payment options like Buy Now, Pay Later (BNPL) have become a key feature of the modern e-commerce experience. BNPL allows consumers to spread out payments, often leading to larger basket sizes.

The growth of BNPL is a significant trend in consumer spending and is changing how people budget for large purchases.

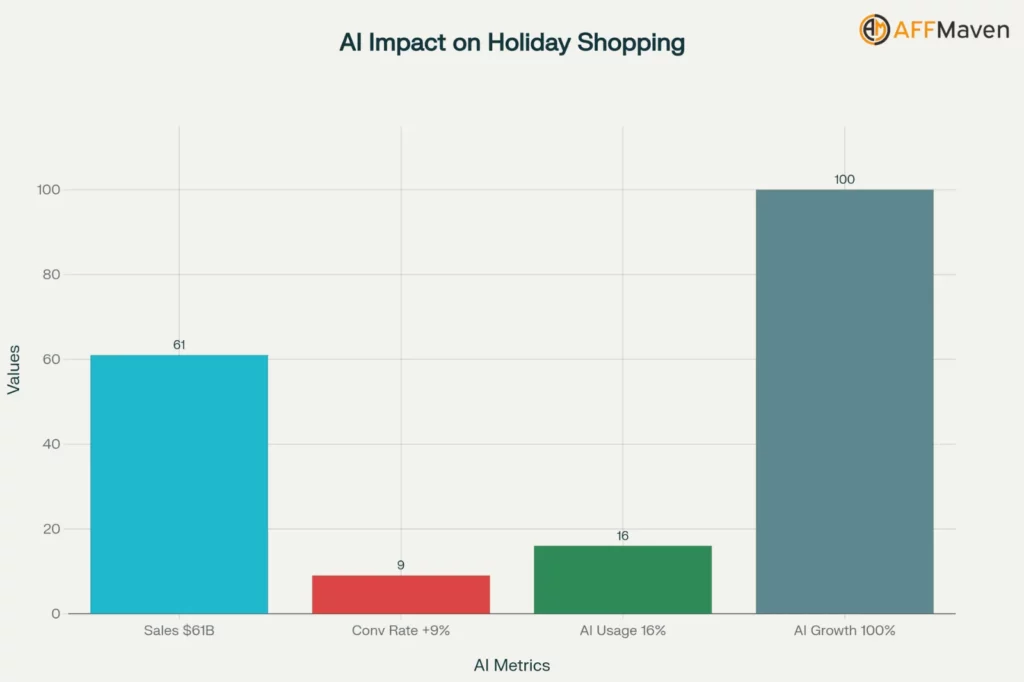

AI’s Influence on Cyber Monday Shopping

Artificial intelligence is playing a larger part in the holiday shopping trends, both for retailers and consumers.

From personalized shopping recommendations to AI-driven chatbots, this technology is optimizing the retail experience. This has led to the rise of AEO (AI Engine Optimization) as a new field for marketers.

As AI tools become more integrated into e-commerce platforms, their impact on sales and customer experience will continue to expand.

Global Reach of Cyber Monday

Though it started in the US, Cyber Monday has grown into a global sales event. Awareness and participation vary by country, but many regions now see significant spikes in shopping activity.

The international growth of Cyber Monday presents new opportunities for global retailers.

Peak Shopping Times and Hourly Spending

Cyber Monday sales are not spread evenly throughout the day. There are clear peak periods when shopper activity and spending surge, typically in the evening.

Retailers can use this information to time promotions and ensure their websites can handle a massive influx of traffic.

Marketing and Advertising During Cyber Week

The days leading up to and including Cyber Monday are some of the most competitive for digital advertising. Retailers invest heavily in marketing to capture shopper attention.

Effective marketing is crucial for cutting through the noise and driving traffic during this busy period.

Conclusion

Cyber Monday remains America’s biggest online shopping event, bringing 197 million Cyber Week participants and electronics discounts hitting 30%.

Mobile commerce dominates with smartphones driving majority sales. Buy Now Pay Later services generated $991 million in purchases while smaller retailers experienced 501% sales increases.

Planning your next holiday campaign means understanding shopper behavior and spending patterns. Will you optimize for evening peak hours or focus on mobile checkout experiences?

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)