Most affiliate marketers treat their business like a cash machine. They withdraw money daily, ignore maintenance, and panic when it breaks. But if you want to sell, you must stop thinking like an operator and start thinking like an investor.

We have brokered and advised on exits for over 12 years at AffMaven. We see the same pattern: a founder wants to sell a site making $10,000 a month, expecting a $400,000 check. Instead, they get offered $150,000—or laughed out of the room. Why? Because they built a job, not a business.

Buyers in 2026 are ruthless. Institutional money has entered the space, and their due diligence teams do not care about your “potential.” They care about predictability, transferability, and documentation.

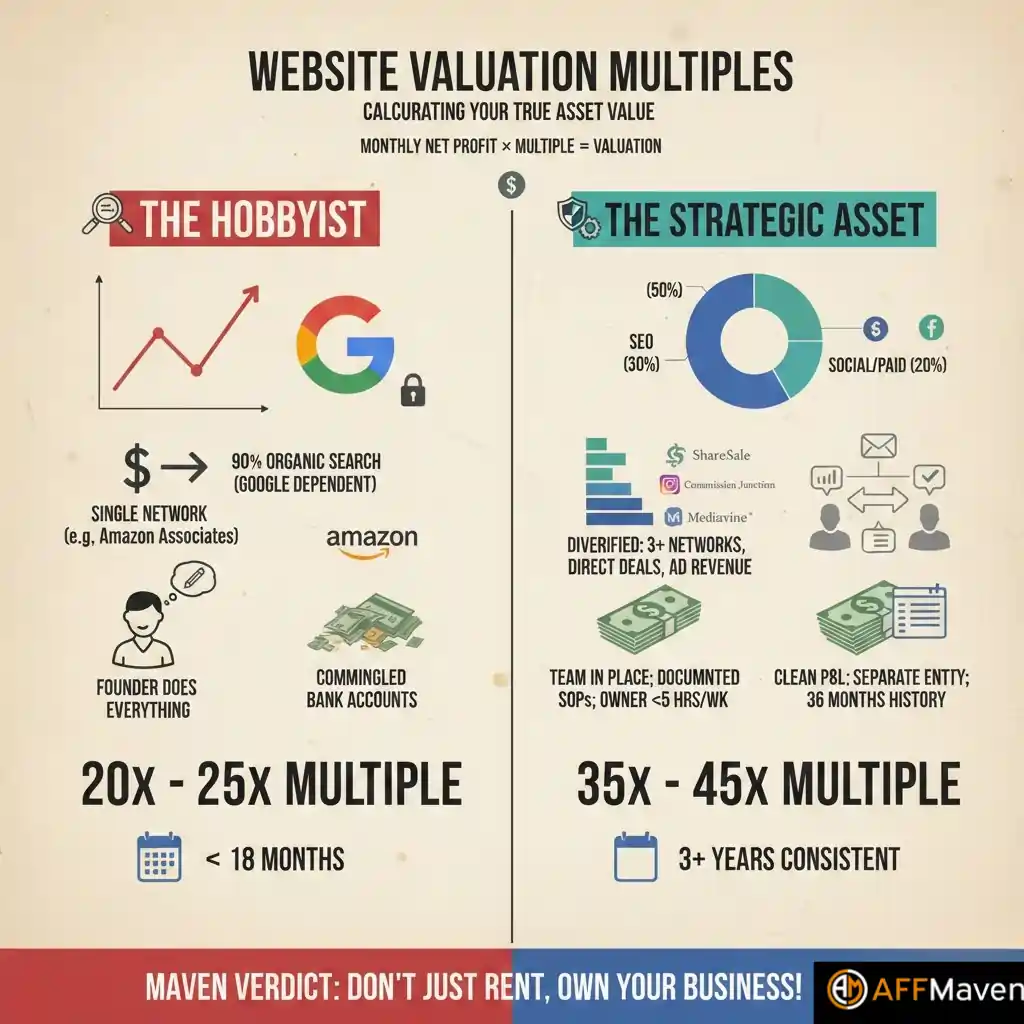

Website Valuation Multiples: Calculating Your True Asset Value

Valuations in the affiliate space rely on a simple formula: Monthly Net Profit × Multiple.

For most content sites, this multiple hovers between 30x and 45x. If your site profits $5,000 a month, it is worth between $150,000 and $225,000. However, that multiple is not random. It is a score of your risk profile.

A site relying on one traffic source with messy books gets a 20x multiple. A brand with an email list, diverse traffic, and Standard Operating Procedures (SOPs) commands a 40x+ multiple.

Here is the data on what separates a “Lifestyle Venture” from a “Strategic Asset” in the current market.

| Metric | The Hobbyist (20x – 25x Multiple) | The Strategic Asset (35x – 45x Multiple) |

|---|---|---|

| Traffic | 90%+ Organic Search (Google dependent) | Balanced: SEO (50%), Email (30%), Social/Paid (20%) |

| Monetization | Single Network (e.g., Amazon Associates only) | Diversified: 3+ Networks, Direct Deals, Ad Revenue |

| Operations | Founder writes/edits/posts everything | Team in place; documented SOPs; owner works <5 hrs/wk |

| Financials | Commingled with personal bank accounts | Clean P&L; separate entity; 36 months of history |

| Age | < 18 months | 3+ years of consistent history |

Maven Verdict: If you rely solely on Amazon Associates and Google SEO, you do not own a business; you rent your income from two tech giants. Buyers will discount your price heavily for that platform risk.

Eliminating Owner Dependency: The “Bus Factor” Protocol

The single biggest deal-killer is owner dependency. Buyers ask one terrifying question: “If the founder gets hit by a bus tomorrow, does the money stop?”

If you personally negotiate deals, write content, or manage links, your business is unsellable. You must fire yourself from daily operations.

Actionable Steps to Reduce Dependency:

When your business can operate without you, it becomes a real asset—not a job. The less your name is tied to daily execution, the higher the valuation climbs.

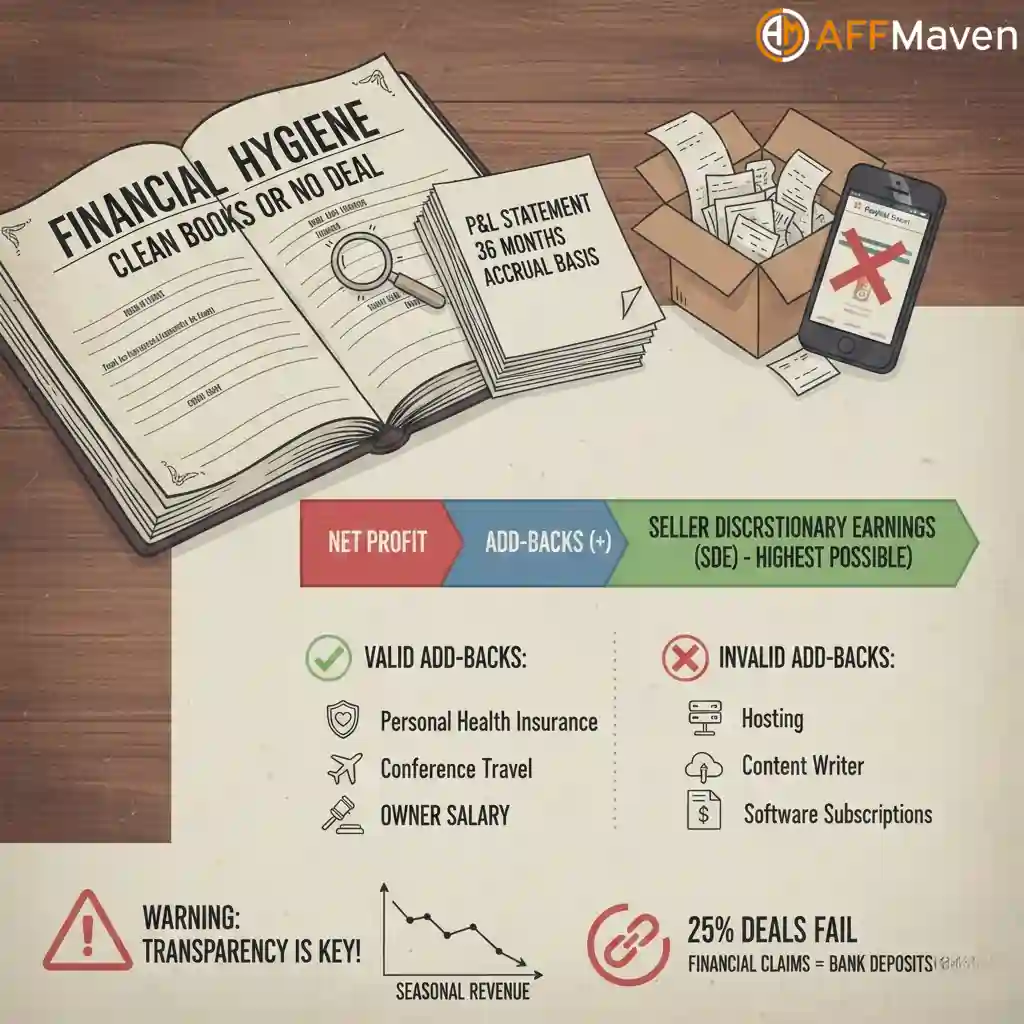

Financial Hygiene: Clean Books or No Deal

Institutional buyers demand “institutional-grade” diligence. If you hand them a shoebox of receipts or a PayPal export, they will walk away.

You need an accrual-based Profit and Loss (P&L) statement going back at least 36 months.

The “Add-Back” Strategy: Your goal is to show the highest possible SDE (Seller Discretionary Earnings). This is your net profit plus any personal expenses you ran through the business that a new owner would not pay.

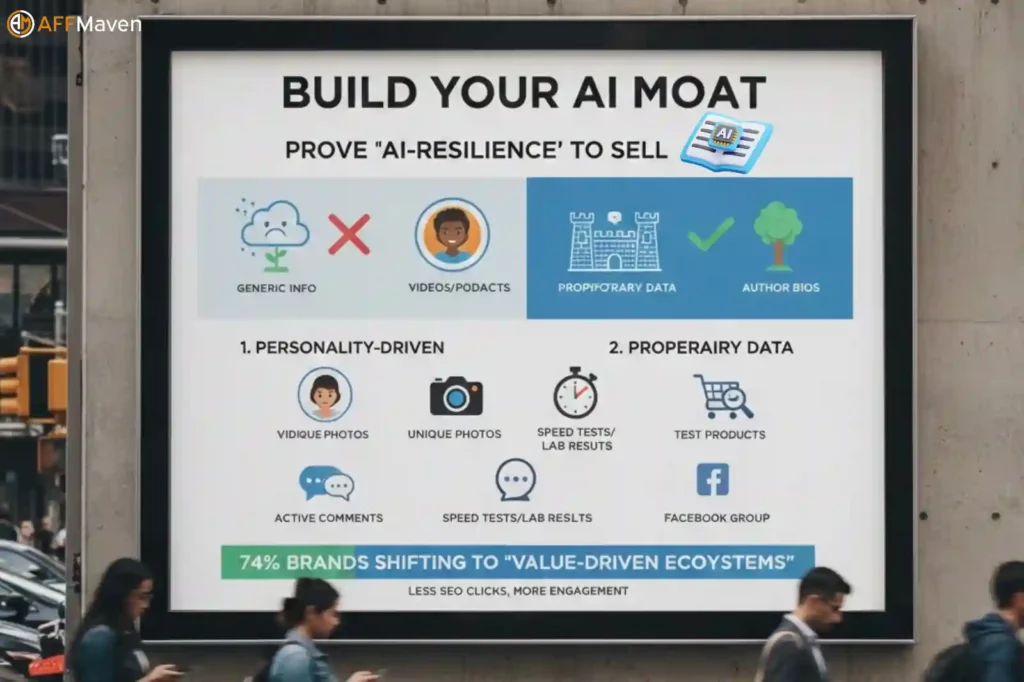

Building an AI Moat: Replacing Generic Info with Proprietary Data

The explosion of AI content has made buyers paranoid. They fear buying a site today that gets wiped out by ChatGPT or a Google Core Update tomorrow.

To sell in 2025, you must prove your site is “AI-Resilient.” Pure information sites (“How to tie a tie”) are toxic assets. You need a brand.

How to Prove AI Resilience:

Stat Check: 74% of brands are increasing affiliate budgets in 2025, but they are shifting funds to partners who provide “value-driven ecosystems” rather than just SEO clicks.

Traffic Diversity: The Anti-Fragile Approach

Relying on Google is gambling. One algorithm update can erase 80% of your valuation overnight. Buyers punish this risk by lowering the multiple.

Implement the 70-20-10 Rule for traffic:

An active email list is the best asset you can build. It is traffic you own. If Google deindexes you, you can still click “Send” and make money. Buyers will often pay a separate, higher valuation for the email list alone.

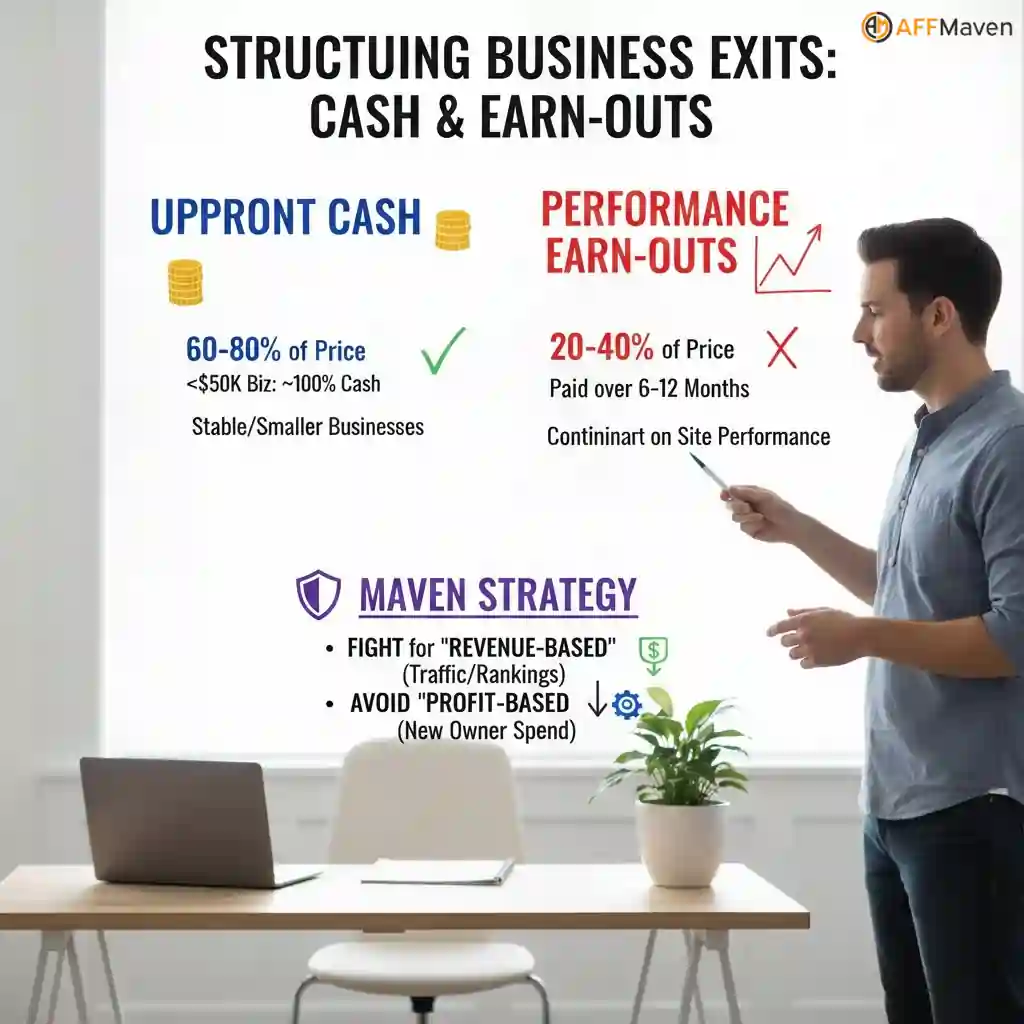

Structuring the Exit: Upfront Cash vs. Performance Earn-Outs

Do not expect 100% cash upfront unless your business is small (<$50k). Larger deals often involve an Earn-Out.

Maven Strategy: Fight for a “revenue-based” earn-out, not “profit-based.” You cannot control how much the new owner spends (profit), but you can argue that the traffic and rankings (revenue potential) are stable.

The Maven Verdict

Selling a site is an emotional process. We have seen founders panic during due diligence because a buyer asked a tough question about a link profile.

Here is the reality: Clean data wins. A smaller site with perfect books and clear SOPs will sell faster than a larger, messy site.

Start preparing now. Even if you do not plan to sell for two years, running your business as if you are selling it makes it more profitable today. It forces you to fix leaks, automate boring tasks, and focus on real growth.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)