As per our analysis in this Paydo Review, we would rate Paydo at 4.8 out of 5.

Google Ratings 4.5

AFFMaven Ratings 4.8

So, I’ve been testing this brilliant payment gateway and e-wallet platform called Paydo, and honestly, it’s been a complete game-changer for my affiliate payment processing workflow!

In 2026, it’s becoming absolutely crucial for anyone running international affiliate programmes or global e-commerce operations, offering the ability to manage multi-currency payments, virtual cards, and mass payouts from one unified dashboard that actually makes financial sense for your business.

And here’s the kicker – you can get dedicated multi-currency IBAN accounts for EUR, GBP, and USD that let you receive payments like a local in over 150 countries, plus issue virtual and physical cards for your team, ad spend, and business expenses directly from your dashboard! 💳

Stick around as we explain everything about Paydo and find out why it’s becoming essential for serious marketers who want to manage global payments professionally and stop losing money on ridiculous banking fees.

What is Paydo? 🏦

Paydo is a payment platform that lets individuals and businesses send and receive funds across the globe. It’s designed for those who need flexibility, security, and a wide choice of payment methods. If you’re running an affiliate network, managing a dropshipping store, or just want a reliable way to get paid, Paydo has you covered with:

Paydo connects with popular e-commerce platforms like WooCommerce and PrestaShop, making it perfect for online stores. The platform automatically converts currencies when needed, so you never miss a payment. Plus, you can add your cards to Apple Pay and Google Pay for quick contactless payments! 📱

With instant virtual card creation, Paydo makes global money management simple for modern businesses.

User Experience: What’s It Like Using PayDo? 🧑💻

Let’s keep it straight—PayDo’s dashboard is clean, modern, and easy to navigate. You won’t be hunting around for features or buried in menus. Everything you need—balances, cards, transfers, and reports—is right at your fingertips.

Support is responsive via email and help desk, and there’s a solid knowledge base if you’re the DIY type.

In short: PayDo feels built for busy marketers and business owners who want to get paid, pay out, and move on with their day. No faffing about.

Key Features of PayDo

Multi-Currency IBANs & Global Reach 🏦

PayDo provides users with dedicated multi-currency IBANs, allowing you to send and receive payments in various currencies without the hassle of opening multiple bank accounts. This is a game-changer for affiliates and digital nomads who work with international partners.

350+ Payment Methods 💳

PayDo stands out by offering a massive range of payment options, from standard credit/debit cards to newer open banking systems and e-wallets. This flexibility means you can accept payments from almost anywhere, using the method that suits your clients best.

Virtual & Physical Cards

You can issue both virtual and physical cards for business or personal use. These cards can be used for online shopping, subscriptions, or even as payout cards for your team or affiliates. Card management is handled directly from the dashboard, making it super easy to keep tabs on your spending.

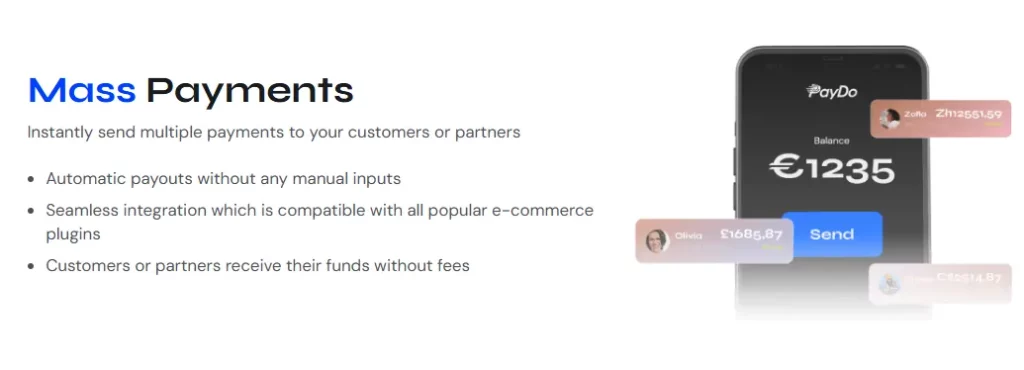

Mass Payments & Automated Payouts

For affiliate networks and businesses handling lots of transactions, PayDo’s API-based mass payments feature lets you send bulk payouts quickly and efficiently. This is perfect for affiliate programs, payroll, or managing payouts to multiple partners.

Checkout & Merchant Services

PayDo’s checkout solution is optimised for both desktop and mobile, ensuring a smooth payment process for your customers. Merchants can integrate PayDo with popular platforms like WooCommerce, PrestaShop, and OpenCart, making it a top pick for e-commerce sites.

Automated KYC & Compliance

The platform uses an automated KYC process—if your transactions exceed €50, you’ll complete a quick verification using QR code scanning and face recognition. This keeps things secure without slowing you down.

Built-in Anti-Fraud & Security

Security is a top priority at PayDo. The platform features real-time fraud monitoring, 3D Secure (3DS) authentication, and is PCI-DSS Level 1 certified for card payments. This means your data and your clients’ funds are well-protected.

Reporting & Analytics

PayDo’s dashboard gives you access to real-time reports, downloadable payment histories, and live currency exchange rates. This makes it easy to keep track of your finances and spot trends in your income and spending.

PayDo Account Types: Which One Fits Your Needs? 📊

Personal Accounts 👤

Perfect for freelancers and digital nomads who need to manage personal finances across multiple currencies. Personal accounts let you hold funds in 12 different currencies and come with both virtual and physical debit cards.

The personal account is ideal if you’re receiving payments from international clients or need to make purchases in different countries without getting hit with hefty foreign exchange fees.

Business Accounts 🏢

Designed for companies that need corporate financial services like payroll management and mass payments. Business accounts support sending and receiving transfers in 35+ currencies and offer access to nine international payment schemes.

If you’re running a remote business or e-commerce store, the business account provides the tools you need to handle international transactions efficiently.

Merchant Accounts 🛒

Built specifically for online businesses that need to process customer payments. The merchant account includes PayDo Checkout, one-click payments, and fraud protection features.

This is your go-to option if you’re running an affiliate marketing business, dropshipping store, or any other online venture that requires robust payment processing capabilities.

How to Create Your PayDo Account in 4 Simple Steps? 📝

Getting started with PayDo is straightforward. Here’s the exact process:

Step 1: Create Your Account

Head over to paydo.com and click the “Open Account” button. You’ll need to provide your email address and create a secure password (minimum 12 characters with uppercase, lowercase, numbers, and special characters). Choose between Personal or Business account type based on your needs.

Step 2: Complete Pre-Verification

After email verification, you’ll fill out a detailed pre-verification form covering your business activities, expected transaction volumes, and source of funds. This is where you’ll specify that you’re in affiliate marketing or digital services.

Step 3: Sign the Contract

PayDo will review your application and provide a service agreement tailored to your business needs. This single contract covers all PayDo services, making it simpler than dealing with multiple payment processors.

Step 4: Complete Full Verification

Submit your KYC documents including identity verification, proof of address, and business registration documents (for business accounts). The verification process typically takes 3-7 business days.

Once approved, you’ll have access to all PayDo features without limits – IBAN accounts, payment processing, virtual cards, and mass payments.

Security & Compliance 🔐

PayDo takes security seriously with several measures in place:

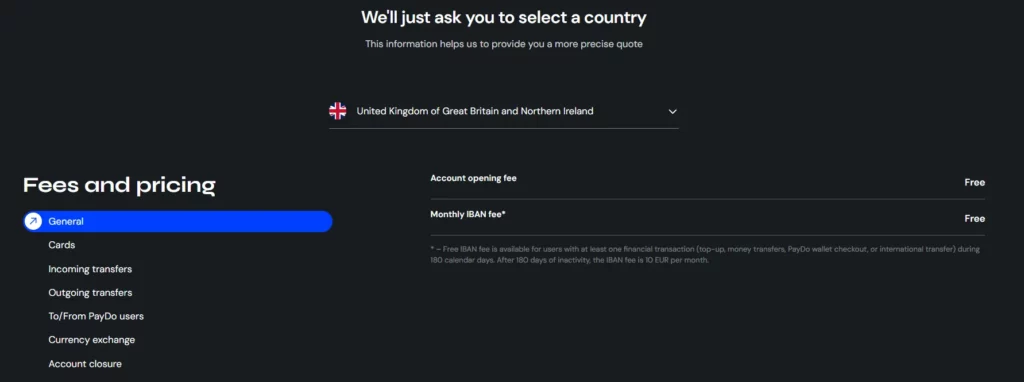

Paydo Pricing 💸

Pricing is always a hot topic, especially for affiliates and businesses watching their bottom line. Here’s the lowdown on Paydo’s pricing structure:

| Account Type | Monthly Fee | Key Features |

|---|---|---|

| Personal Account | €0.00 | Multi-currency IBAN, e-wallet, virtual cards, global transfers |

| Business Account | From €100.00 | Dedicated IBANs, merchant checkout, mass payouts, physical cards, integrations |

Customer Support: Is PayDo There When You Need Them? 🙋♂️

Customer support can make or break your experience—especially when money’s on the line.

- Registered users can create support tickets directly from the dashboard, choosing the relevant department for faster help.

- Non-users can reach out via email (s[email protected]) or the contact form.

From what I’ve seen, response times are quick and the team is knowledgeable—especially for business and compliance queries.

Pros and Cons: The Honest Truth ✅❌

The Good Stuff ✅

The Not-So-Good Stuff ❌

Who Should Use PayDo? 🎯

PayDo is particularly well-suited for:

Paydo vs. Other Payment Platforms 🥊

To give you a fair picture of where Paydo stands in the market, let’s compare it with some major competitors that affiliate marketers and online businesses commonly use.

| Feature | Paydo | PayPal | Stripe | Wise | Pleo |

|---|---|---|---|---|---|

| Multi-currency IBANs | ✅ Yes | ❌ No | ❌ No | ✅ Yes | ❌ No |

| Virtual Cards | ✅ Yes | ❌ No | ❌ No | ✅ Yes | ✅ Yes |

| Physical Cards | ✅ Yes | ✅ Yes | ❌ No | ✅ Yes | ✅ Yes |

| Mass Payments | ✅ Yes | ✅ Yes | ❌ No | ✅ Yes | ❌ No |

| API Integration | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Merchant Services | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No | ❌ No |

| Monthly Fee | €0-€100 | €0 | €0 | €0 | £9.50+ |

| Transaction Fees | 0.5-3% | 2.9-4.4% | 2.9% | 0.5-1% | Varies |

| Global Reach | 150+ countries | 200+ countries | 46+ countries | 80+ countries | Europe |

How Paydo Stacks Up 📊

Paydo’s main strengths compared to competitors:

Final Verdict: Is PayDo Worth It? 🎯

PayDo presents a solid option for users who need multi-currency banking and international payment capabilities. The platform excels in serving businesses that operate globally and individuals who frequently deal with multiple currencies.

The service is particularly valuable for high-risk industries that struggle to find banking partners elsewhere. The combination of IBAN accounts, payment processing, and card services provides operational efficiency that can justify the costs for active businesses.

Rating: 4.8/5

PayDo earns strong marks for functionality, regulatory compliance, and industry coverage. The main drawbacks are geographic limitations and pricing structure that may not suit all users.

Bottom Line: PayDo is recommended for international businesses, digital nomads, and merchants who can fully utilise its multi-currency and payment processing capabilities.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)

![LunaProxy Review 2026: Get 77% OFF [$0.7/GB] 200M+ Proxies 18 LunaProxy Review](https://affmaven.com/wp-content/uploads/2025/01/LunaProxy-Review-5-1024x512.webp)