Telegram isn’t just another chat app-it’s a global beast now, smashing past 1 billion monthly users in 2026.

What started as a privacy-focused underdog has become one of the world’s top messaging platforms, with half a billion folks logging in daily. From massive group chats and giant file drops to a buzzing premium scene, Telegram’s got features that keep users coming back for more.

Its reach is wild, especially in Asia and Europe, and it’s even shaking up e-commerce and digital business. If you want the real numbers and what’s fuelling Telegram’s rise, stick around-these stats might just change how you see messaging.

Telegram User Statistics: Breaking the Billion Barrier

The messaging giant officially crossed the 1 billion monthly active user milestone in 2026, cementing its position as one of the world’s top communication platforms.

Monthly Active Users Growth (2014-2026)

Telegram’s growth trajectory has been consistently impressive:

| Year | Monthly Active Users | Year-on-Year Growth |

|---|---|---|

| March 2025 | 1 billion | 5.3% |

| January 2025 | 950 million | 5.6% |

| July 2024 | 950 million | 5.6% |

| April 2024 | 900 million | 12.5% |

| 2023 | 800 million | 14.3% |

| June 2022 | 700 million | 75% |

| 2021 | 550 million | 37.5% |

| April 2020 | 400 million | 33.3% |

| 2019 | 300 million | 50% |

| March 2018 | 200 million | 33.3% |

| 2017 | 150 million | 87.5% |

| February 2016 | 100 million | 25% |

| 2015 | 50 million | 42.9% |

| March 2014 | 35 million | N/A |

This represents a staggering 2,757% increase from 2014 to 2026, with the platform now reaching approximately 11% of the global population.

Daily Active Users (DAU)

Telegram’s daily engagement is equally impressive:

- 2025: 500 million DAU (estimated)

- 2024: 450 million DAU

- 2023: 196 million DAU (iOS and Android only)

Approximately 50% of monthly users engage with Telegram daily, demonstrating strong user retention and platform stickiness.

Messages and Media Shared

- Daily messages exchanged: 15 billion + (2026)

- Daily messages exchanged: 12 billion (2024)

- File sharing capacity: 2GB for regular users, 4GB for premium users

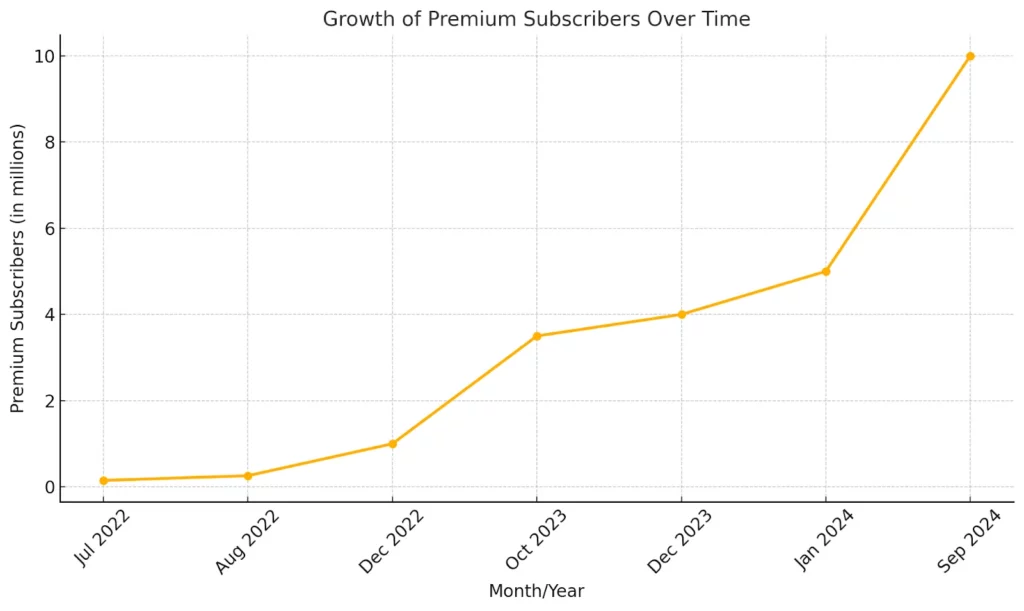

Telegram Premium Subscribers: A Growing Revenue Stream

Telegram Premium, launched in June 2022, has shown impressive growth despite representing just 1% of the total user base.

| Month/Year | Premium Subscribers | Monthly Growth Rate |

|---|---|---|

| September 2024 | 10 million | N/A |

| January 2024 | 5 million | 25% |

| December 2023 | 4 million | 14.3% |

| October 2023 | 3.5 million | 250% |

| December 2022 | 1 million | 284.6% |

| August 2022 | 0.26 million | 73.3% |

| July 2022 | 0.15 million | N/A |

Premium subscribers enjoy enhanced features like doubled file upload limits, faster downloads, exclusive stickers, and advanced chat management options.

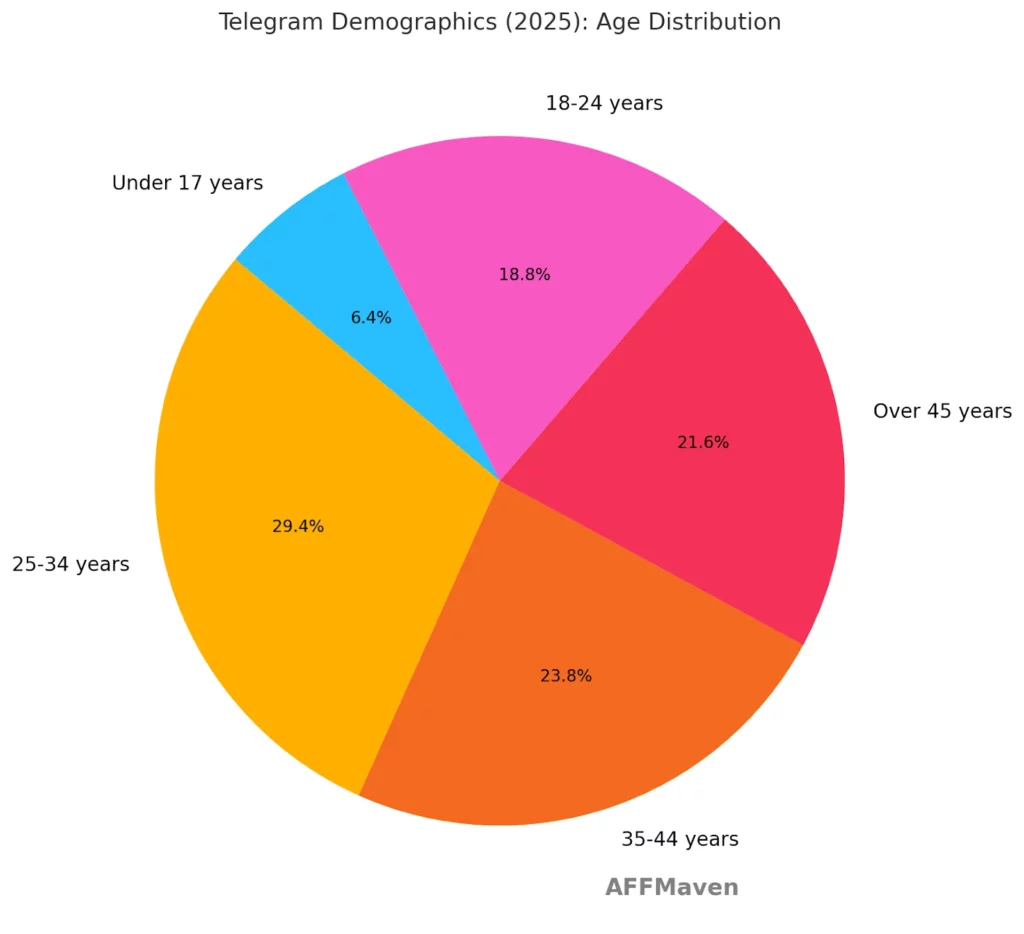

Telegram Demographics: Who’s Using the Platform?

Age Distribution (2026)

Telegram appeals primarily to users between 25-44 years old:

Gender Split

The platform shows a notable male skew across multiple data sources:

This male-dominated user base differs from some other social platforms that typically show more balanced gender distribution or even female skew.

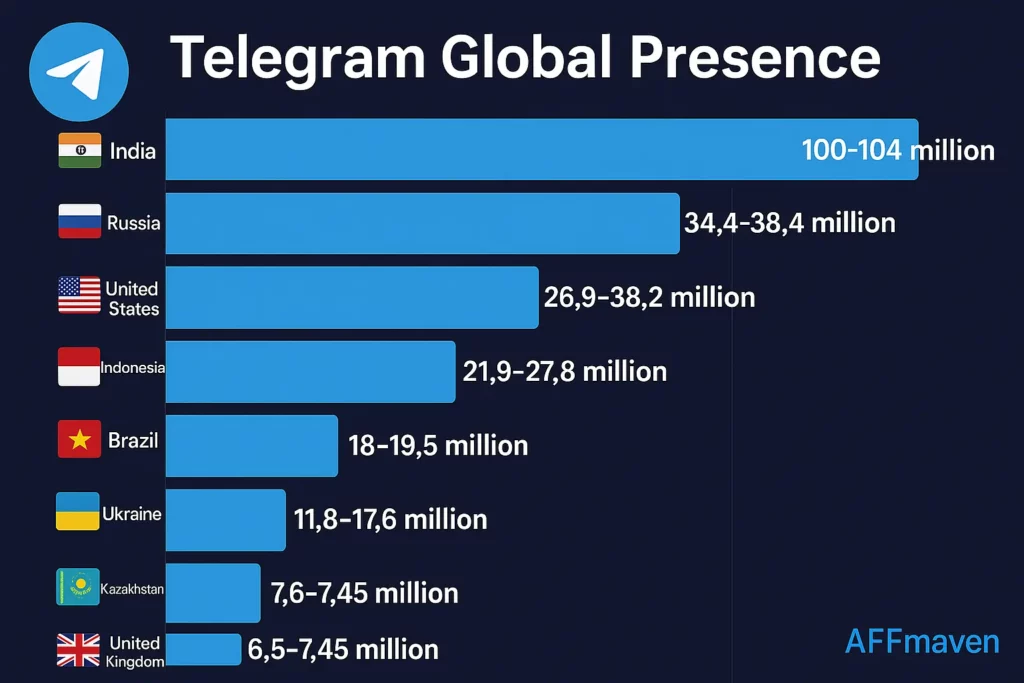

Telegram Global Presence: Country-wise Report

Top Countries by Downloads

India leads the global Telegram adoption race by a significant margin:

| Country | Telegram App Downloads | % of Global Downloads |

|---|---|---|

| India | 100-104 million | 23-24% |

| Russia | 34.4-38.4 million | 8-9% |

| United States | 26.9-38.2 million | 6-9% |

| Indonesia | 24.3-27.2 million | 5.6-6.3% |

| Brazil | 21.9-22.8 million | 5.1-5.3% |

| Vietnam | 11.8-17.6 million | 2.7-4.1% |

| Ukraine | 10.8-11.8 million | 2.5-2.7% |

| Kazakhstan | 7.6-9.36 million | 1.8-2.2% |

| France | 6.5-7.45 million | 1.5-1.7% |

| United Kingdom | 6.04 million | 1.4% |

In terms of population penetration, approximately 45% of Indians with internet access use Telegram regularly, compared to just 9% of Americans.

Regional Distribution of Users (2022-2026)

| Region | Percentage of Users |

|---|---|

| Asia | 38% |

| Europe | 27% |

| Latin America | 21% |

| MEMA (Middle East & Africa) | 8% |

| Other regions | 6% |

Asia remains Telegram’s strongest market, with particularly high adoption in countries with strict internet regulations or censorship concerns.

User Engagement Metrics: How People Use Telegram

Time Spent and Usage Patterns

Telegram users demonstrate strong engagement with the platform:

Compared to other social platforms, Telegram ranks 8th for time spent, with TikTok (34 hours) and YouTube (28 hours) leading the pack.

Activity Types

Users engage with Telegram in multiple ways:

- Messaging: 97% of users

- Consuming content via channels: 85% of users

- Participating in group chats: 78% of users

- Voice/video calls: 45% of users

- Using bots: 32% of users

Telegram Download Statistics: Global Adoption

Annual Downloads (2014-2026)

Telegram continues to see strong download numbers across app stores:

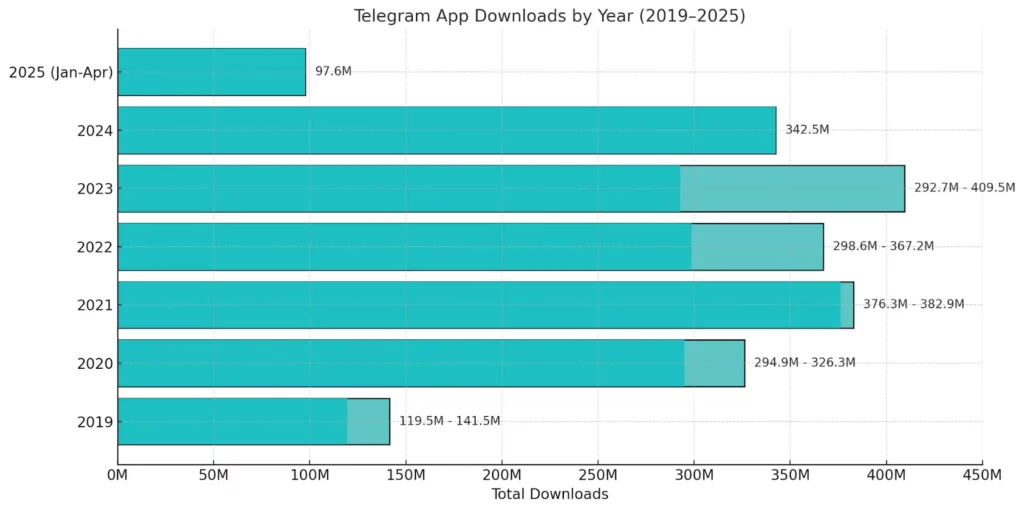

| Year | Total Downloads | Year-on-Year Growth |

|---|---|---|

| 2025 (Jan-Apr) | 97.6 million (est.) | N/A |

| 2024 | 342.5 million | 16.7% |

| 2023 | 292.7-409.5 million | -2-11.5% |

| 2022 | 298.6-367.2 million | -4-20.6% |

| 2021 | 376.3-382.9 million | 17.3-26.6% |

| 2020 | 294.9-326.3 million | 108.4-146.7% |

| 2019 | 119.5-141.5 million | N/A |

January 2025 alone saw 27.6 million+ new downloads globally, indicating continued strong growth.

Cumulative Downloads (2014-2023)

| Year | Cumulative Downloads (mm) |

|---|---|

| 2023 | 2,070 |

| 2022 | 1,650 |

| 2021 | 1,270 |

| 2020 | 840 |

| 2019 | 515 |

| 2018 | 340 |

| 2017 | 250 |

| 2016 | 180 |

| 2015 | 130 |

| 2014 | 100 |

Telegram surpassed the 1 billion download milestone in 2021 and has doubled that figure by 2023.

Regional Distribution of Downloads (Q4 2023-Q1 2025)

- Europe, Middle East & Africa (EMEA): 46.17 million+

- Asia Pacific (APAC): 63 million+

- Americas: 24.38 million+

India alone accounted for 100 million+ downloads, making it Telegram’s largest market by far.

Telegram Revenue Statistics: Monetization Growth

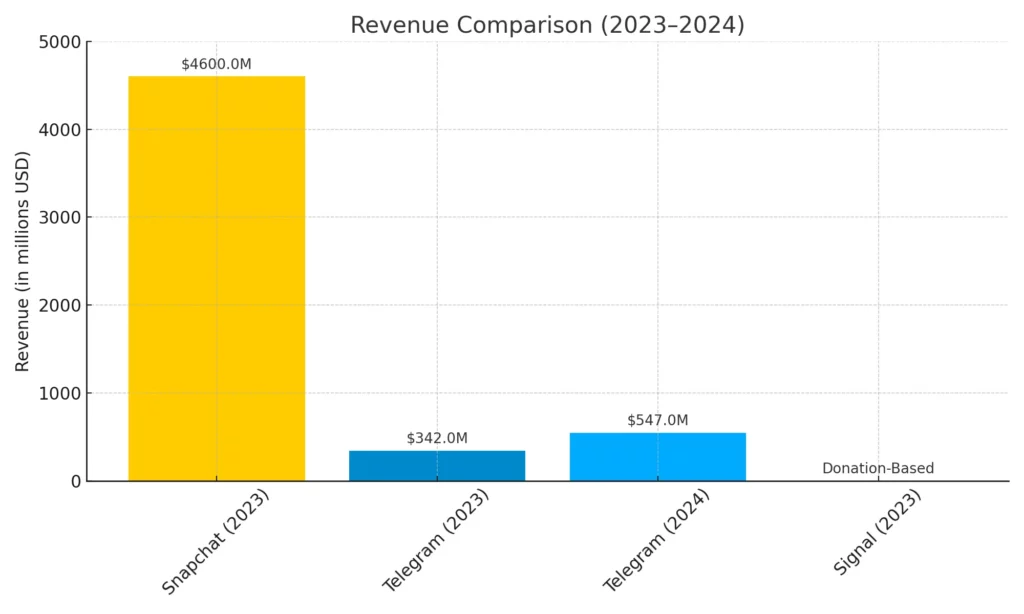

Annual Revenue Growth

Telegram’s revenue figures have accelerated with the introduction of premium subscriptions and ads:

| Year | Total Revenue | Year-on-Year Growth |

|---|---|---|

| 2024 | $547 million | 59.9% |

| 2023 | $342 million | 396.5% |

| 2022 | $68.8 million | 52.9% |

| 2021 | $45 million | N/A |

Revenue sources include Premium subscriptions, advertising, and the TON cryptocurrency ecosystem.

In-App Revenue Breakdown (2023-2026)

Monthly in-app revenue shows a clear upward trend:

| Month/Year | App Store Revenue | Google Play Revenue | Total In-App Revenue |

|---|---|---|---|

| January 2025 | $10.5 million | $3.1 million | $13.6 million |

| February 2024 | $4.86 million | $1.22 million | $6.08 million |

| January 2024 | $4.44 million | $1.14 million | $5.58 million |

| December 2023 | $3.87 million | $0.97 million | $4.84 million |

This represents massive growth from previous years, with in-app revenue nearly tripling between December 2023 and January 2025.

Popular Telegram Channels and Content Types

Most-Followed Telegram Channels (2026)

- Telegram Tips: 10.89 million subscribers

- Telegram Premium: 7.34 million subscribers

- Telegram News: 7.11 million subscribers

- Proxy MTProto: 7.11 million subscribers

- Notcoin Community: 6.10 million subscribers

- MicroStrategy: 5.87 million subscribers

- Binance News: 5.55 million subscribers

- Crypto News International: 5.33 million subscribers

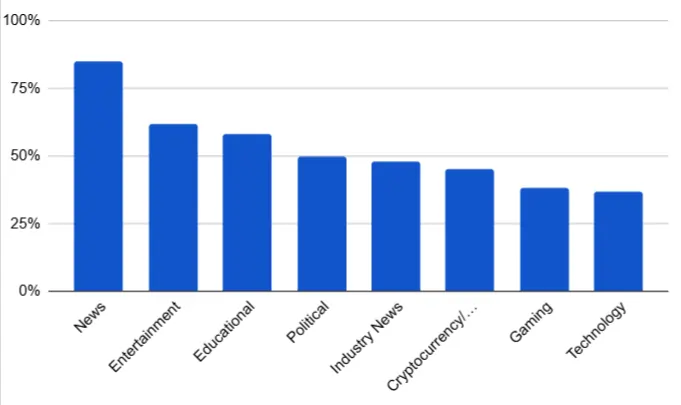

Channel Category Popularity

Users follow a diverse range of channel types:

Telegram Features and Tools Adoption

Core Feature Usage

Telegram’s extensive feature set contributes significantly to its popularity:

- Group chat capacity: Up to 200,000 members (vs 1,024 for WhatsApp)

- Large file sharing: 2GB for regular users, 4GB for premium users

- Bot platform: 10+ million active bots

- Sticker collections: 100,000+ free sticker packs

- Channel monetization: 50% of ad revenue to channel owners

Third-Party Engagement Tools

An ecosystem of specialized tools has emerged to enhance Telegram functionality:

Conversational AI Tools

Gaming Integration

Monetization Tools

Analytics Platforms

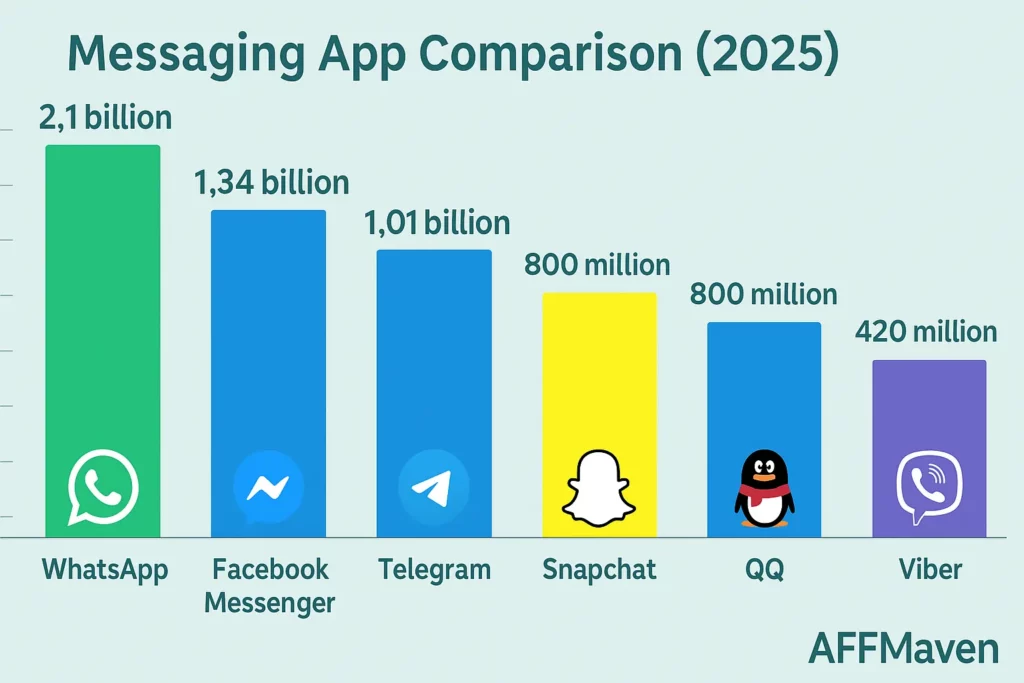

Telegram vs Competitors: Market Position

Telegram ranks impressively among social and messaging platforms:

- 8th most popular social media platform globally

- 4th most popular mobile messaging app worldwide

- 5th most downloaded app globally till 2026

Messaging App Comparison (2026)

| Platform | Monthly Active Users |

|---|---|

| 2.1 billion | |

| 1.34 billion | |

| Facebook Messenger | 1.01 billion |

| Telegram | 1 billion |

| Snapchat | 800 million |

| 554 million | |

| Viber | 420 million |

Download Comparison (Q4 2024)

Revenue Comparison (2023-2024)

Security and Privacy Considerations

Despite its popularity, Telegram faces some security criticisms:

Encryption Approach

Content Moderation Challenges

Privacy Features

🛒 Telegram E-commerce Activity

Telegram has evolved into a significant e-commerce channel for various categories:

Sales Volume by Category

| Segment | Sales Volume on Telegram |

|---|---|

| Goods from China | $12 million |

| Digital Equipment | $5.52 million |

| Consumer Loans | $3.12 million |

| Apparel and Shoes | $2.14 million |

| Sports Equipment | $0.86 million |

| Food Delivery | $0.57 million |

| Health Products | $0.42 million |

| Beauty Products | $0.38 million |

This demonstrates Telegram’s evolution beyond messaging into a more comprehensive platform for business and commerce.

E-commerce Strategies

Telegram Username Market

Unique Telegram usernames have become valuable digital assets on the Fragment marketplace:

| Username | Sale Price |

|---|---|

| @news | $5.81 million |

| @auto | $5.27 million |

| @bank | $4.97 million |

| @avia | $4.68 million |

| @chat | $4.1 million |

| @hotel | $3.82 million |

| @travel | $3.6 million |

| @cryptocurrency | $3.45 million |

| @casino | $3.2 million |

| @crypto | $2.8 million |

The username market represents a unique digital asset class emerging within the Telegram ecosystem.

Future Growth Projections

Based on current trajectories, experts project continued growth for Telegram:

User Growth Forecasts

Revenue Projections

Premium Subscriber Forecasts

The Bottom Line

Telegram’s journey to joining the billion-user club solidifies its position as a major player in global communications. From its humble beginnings in 2013 to becoming the fourth most popular messaging app worldwide, Telegram has shown remarkable resilience and growth.

While facing challenges related to content moderation, security, and monetization, its continued expansion suggests these haven’t significantly hampered its popularity. With its diverse feature set, strong privacy positioning, and growing monetization avenues, Telegram is poised to remain a dominant force in digital communications for years to come.

For marketers, community builders, and businesses, Telegram represents a massive opportunity to reach engaged audiences, build communities, and even develop direct sales channels-all on a platform that continues to grow and evolve at an impressive pace.

Affiliate Disclosure: This post may contain some affiliate links, which means we may receive a commission if you purchase something that we recommend at no additional cost for you (none whatsoever!)